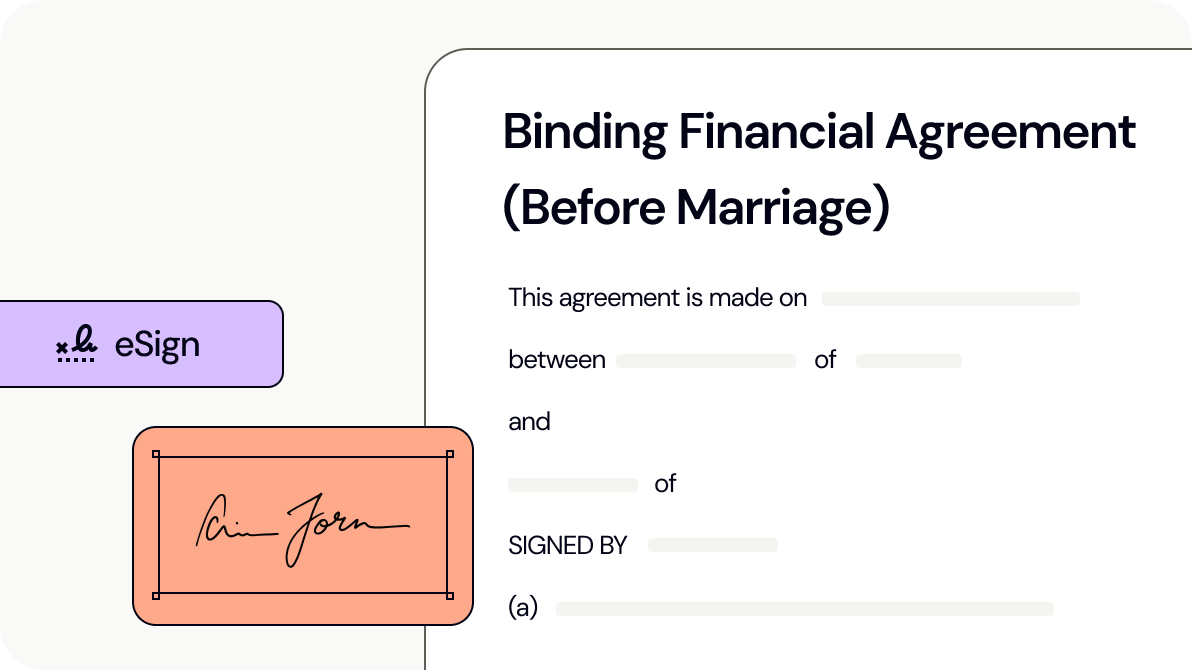

Binding Financial Agreement (Before Marriage)

This Agreement can be used to secure the assets of both parties to a prospective marriage in case of relationship breakdown.

Last updated April 15, 2025

Suitable for Australia

Create & Customise Legal Templates Online

What is a binding financial agreement (before marriage)?

What is a binding financial agreement (before marriage)?

When should you use a binding financial agreement (before marriage)?

When should you use a binding financial agreement (before marriage)?

What should be in a binding financial agreement (before marriage)?

What should be in a binding financial agreement (before marriage)?

How to create a legal document

- check_circle

Access the Document Library

- check_circle

Select the template that matches your needs

- check_circle

Customise by adding or removing clauses with assistance from Lawpath AI

- check_circle

Personalise with your headers, footers, logos, or additional text

- check_circle

Store all documents securely in your account for easy access

Frequently asked questions

What is a binding financial agreement (before marriage)?

keyboard_arrow_upWhen should you use a binding financial agreement (before marriage)?

keyboard_arrow_upWhat should be in a binding financial agreement (before marriage)?

keyboard_arrow_upWhat protections does this agreement provide?

keyboard_arrow_upAre there any limitations or risks with this agreement?

keyboard_arrow_upIs this agreement suitable for de facto couples?

keyboard_arrow_upWhat are the next steps after preparing the agreement?

keyboard_arrow_upView Sample Binding Financial Agreement (Before Marriage)

Articles about Binding Financial Agreement (Before Marriage)

Looking for more documents?

Will

A Will is an essential document as part of your estate plan. This Will cannot be e-signed.

Resume (Graduate)

A Resume (Graduate) provides detailed information about yourself for job applications and a way to showcase your education, skills, experience and achievements to potential employers.

Variation of Discretionary Trust

Create your document of Discretionary Trust terms quickly with instant document builder of Lawpath. Create quality documents easily. Try it now!

Sublease Agreement (Residential)

A Sublease Agreement allows you, as a tenant to sublease your residential property to a subtenant.

Cease and Desist Letter

A Cease and Desist Letter offers you a quick, cost effective, and efficient way to formally ask an individual or a business to stop a certain activity.

Promissory Note

A Promissory Note is a negotiable instrument that allows you to set out the payment of a sum of money.

Credit Card Authorisation Form

The Credit Card Authorisation Form is a document that allows a cardholder to give another entity authority to charge a specified amount on the cardholder's card.

Letter of Demand (1st attempt)

A Letter of Demand (1st attempt) can be used to formally request payment of an outstanding debt.