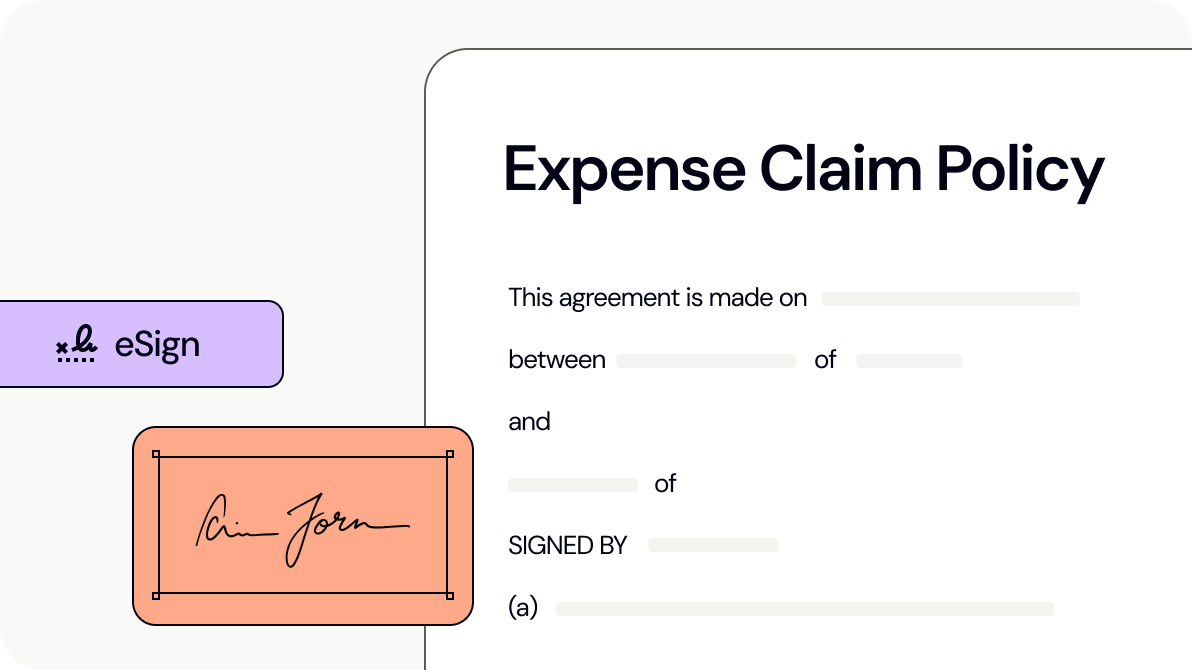

Expense Claim Policy

An Expense Claim Policy is an important part of your business’ HR and employment policies.

Last updated October 21, 2025

Suitable for Australia

Create & Customise Legal Templates Online

What is a expense claim policy?

What is a expense claim policy?

When should you use a expense claim policy?

When should you use a expense claim policy?

What should be in a expense claim policy?

What should be in a expense claim policy?

How to create a legal document

- check_circle

Access the Document Library

- check_circle

Select the template that matches your needs

- check_circle

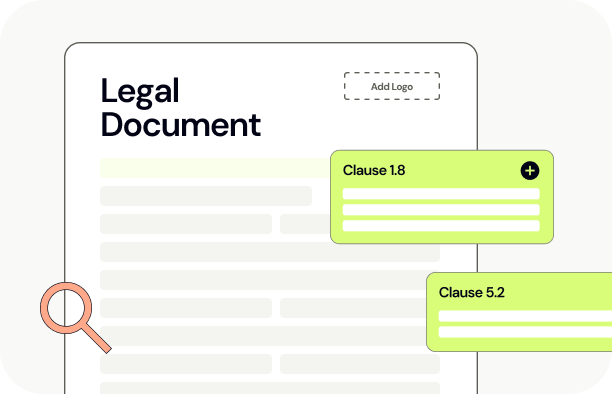

Customise by adding or removing clauses with assistance from Lawpath AI

- check_circle

Personalise with your headers, footers, logos, or additional text

- check_circle

Store all documents securely in your account for easy access

Frequently asked questions

What is a expense claim policy?

keyboard_arrow_upWhen should you use a expense claim policy?

keyboard_arrow_upWhat should be in a expense claim policy?

keyboard_arrow_upWho benefits from having this policy in place?

keyboard_arrow_upWhat expenses are typically not reimbursable?

keyboard_arrow_upAre there any risks or limitations to be aware of?

keyboard_arrow_upWhat steps should I take to implement this policy?

keyboard_arrow_upView Sample Expense Claim Policy

The Legal Risk Score of a Expense Claim Policy Template is Low

Our legal team have marked this document as low risk considering:

- The policy requires pre-approval from a manager or the CEO for certain expenses, which could delay or complicate reimbursement if timely approvals are not obtained.

- Employees must provide detailed documentation, including receipts and justification for expenses, which could be challenging if proper records are not maintained or if the documentation is lost.

- The policy specifies non-reimbursable expenses and requires bookings to be made through specific channels, which might limit flexibility and increase the personal financial burden if not adhered to.

This document imposes structured and detailed requirements on expense claims, which may reduce the risk of unauthorised or fraudulent claims but could also increase the administrative burden on employees. Compared to other policies, this document provides clear guidelines and expectations, which, if followed, can minimise misunderstandings and disputes over reimbursements, but it requires diligent record-keeping and adherence to specific procedures.

Articles about Expense Claim Policy

Looking for more documents?

Employment Agreement (Casual)

This Employment Agreement (Casual) is suitable for casual employees in any industry. This agreement is essential when hiring new casual employees for your business.

Contractor Agreement (Individual)

The Contractor Agreement (Individual) allows you to hire a contractor that is an individual (ie. not a company).

Shareholders Agreement

A Shareholders Agreement allows you to clarify the relationship between shareholders of your company.

Full Time Employment Agreement

This Full Time Employment Agreement covers everything you need when hiring a new full time employee. It is applicable to any industry in Australia.

Consultancy Agreement (Pro-Supplier)

A Consultancy Agreement (Pro-Supplier) can be used if you provide consultancy services or engage consultancy services from another entity. This version of the Consultancy Agreement is drafted in favour of the supplier, from a commercial and legal perspective.

Website Terms and Conditions of Use (Goods)

This Website Terms And Conditions of Use (Goods) outlines the rules people must follow when using your website. It includes protection for your IP, disclaimers to limit your liability and makes you compliant with Australian law.

Contractor Agreement (Company)

A Contractor Agreement (Company) allows you to engage a contractor that is a company.

Internship Agreement

An Internship Agreement is used when hiring an unpaid intern for your business.