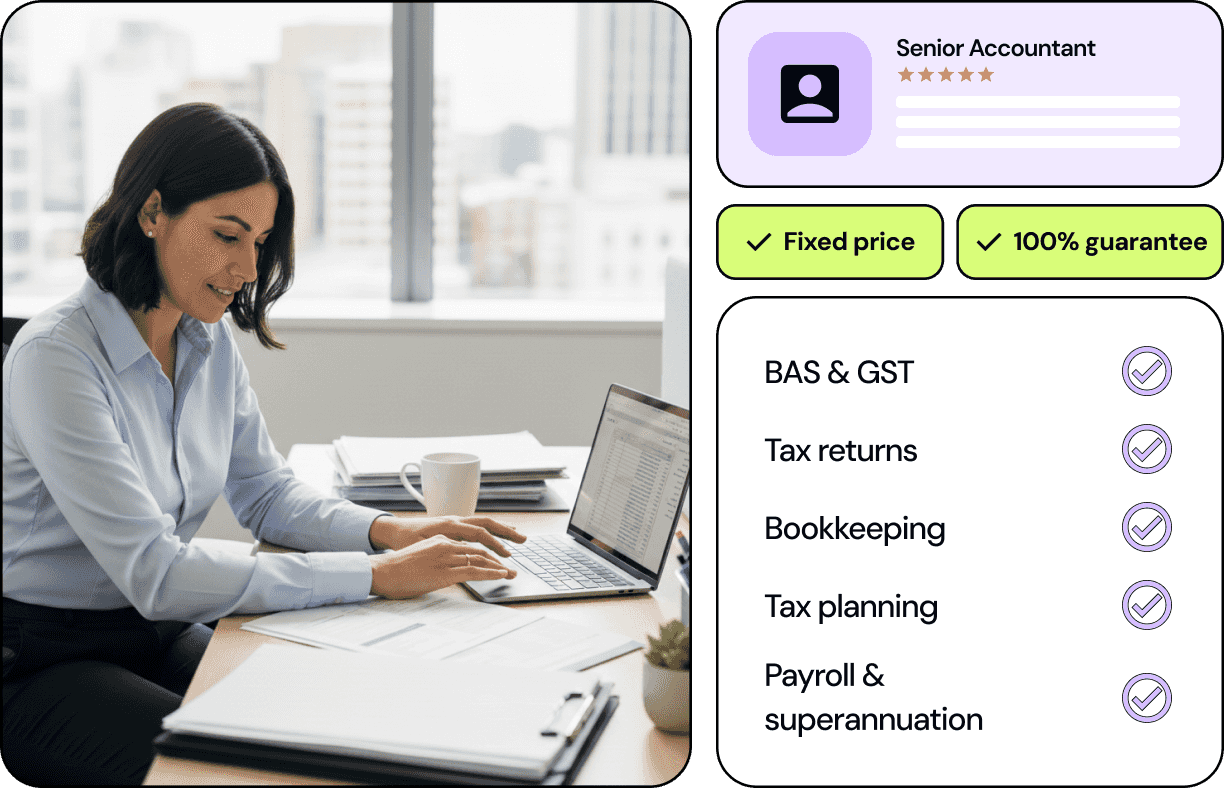

Lawpath Accounting combines AI that works around the clock with experienced Australian accountants who know small business inside out. Fixed-price tax, BAS and bookkeeping - no billable-hour surprises.

Traditional accountants

Lawpath Accounting

Quarterly and annual BAS preparation and lodgement. GST compliance, input tax credits and activity statement reconciliation - accurate and on time.

Company, trust, partnership and individual tax returns prepared by experienced accountants. Maximise deductions and ensure full ATO compliance.

Transaction categorisation, bank reconciliation and financial record maintenance. AI handles the repetitive work so your books stay clean year- round.

End-to-end payroll processing, STP reporting, super guarantee lodgement and payroll tax. Keep your team paid correctly and your business compliant.

Proactive strategies to minimise tax liabilities throughout the year - not just at EOFY. Structuring advice, timing strategies and deduction planning.

Profit and loss, balance sheet and cash flow statements prepared to ATO standards. Clear reporting that gives you the insights to make better decisions.

Sole trader, company, trust or partnership - expert advice on the right entity structure for your tax position, liability exposure and growth plans.

Annual reviews, company renewals, changes of officeholders and ASIC lodgements. Stay on top of your corporate compliance obligations without the headache.

Identify eligible R&D activities, prepare schedules and lodge claims for the refundable tax offset. Maximise your incentive while staying within ATO guidelines.

Pre-reconciles GST transactions, flags input tax credit errors and mismatched ABNs, and generates a draft BAS before your accountant reviews and lodges.

Quarterly auto-prep

Tracks every ATO deadline - BAS, IAS, tax returns, FBT, PAYG instalments and super guarantee dates. Sends proactive alerts so you never cop a late penalty.

Never miss a deadline

Analyses income and expense patterns, predicts cashflow shortfalls 30-60 days out, and alerts you and your accountant before problems become crises.

Real-time monitoring

Auto-categorises transactions, matches receipts to expenses, reconciles bank feeds and flags coding errors before they compound into messy books.

Continuous reconciliation

Scans your expenses against ATO rulings and case law to surface missed deductions - depreciation, home office, motor vehicle, travel, and asset write-offs.

Maximise every claim

Monitors award rate changes, super guarantee thresholds, STP requirements and payroll tax brackets. Alerts you before pay runs when rates need updating.

Award rate tracking

Continuously checks your returns against common ATO audit triggers - unusual deductions, benchmarking ratios and reporting anomalies - before you lodge.

Pre-lodgement checks

Generates P&L, balance sheet and cash flow statements on demand. Compares against prior periods and highlights trends your accountant should review.

Reports on demand

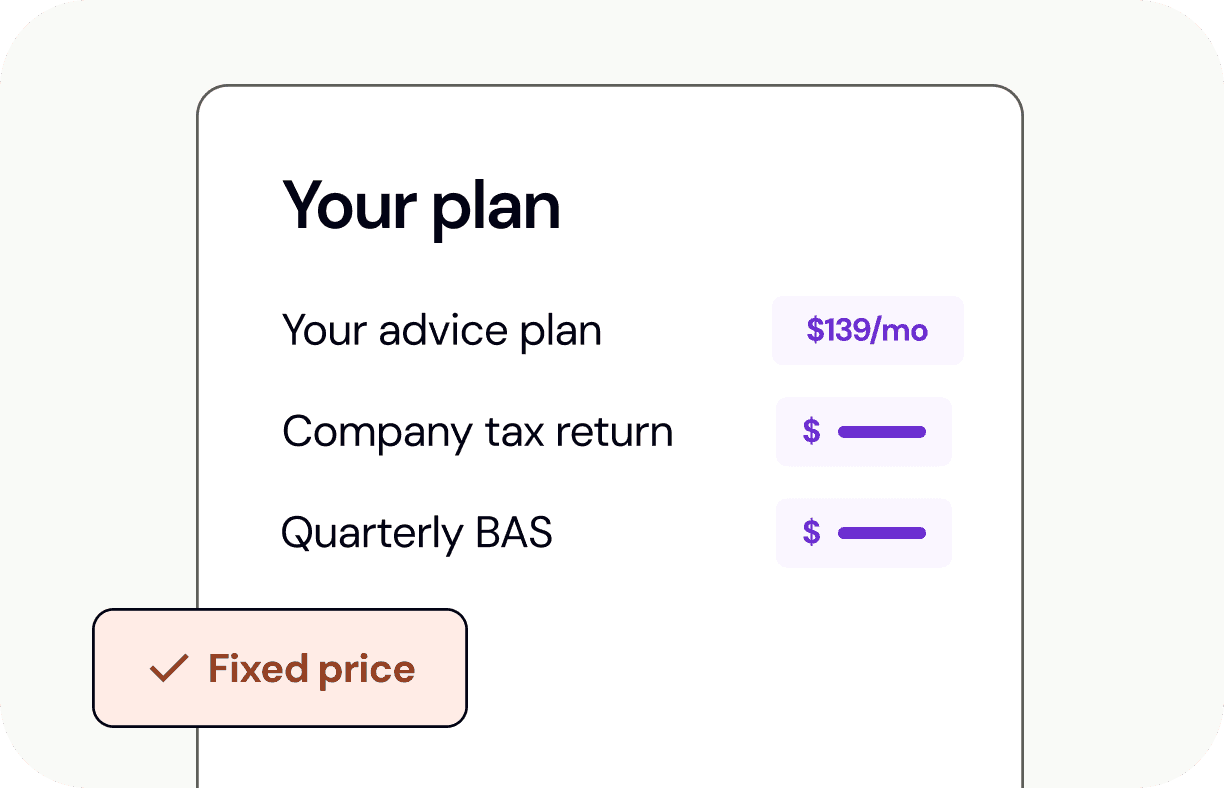

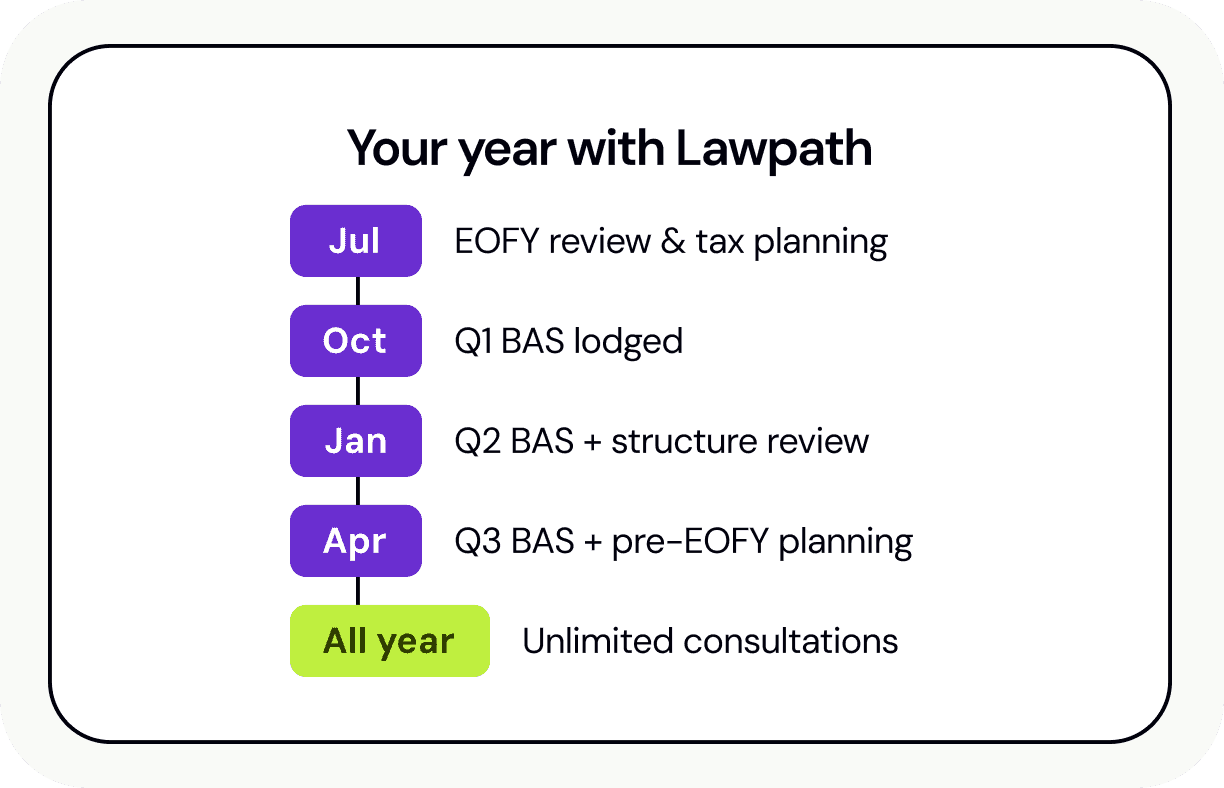

Unlimited accounting consultations for $139 a month. Tax returns, BAS lodgement and bookkeeping all come with a fixed-price quote before work starts. No timesheets ticking away in the background, no invoice shock at the end of the quarter.

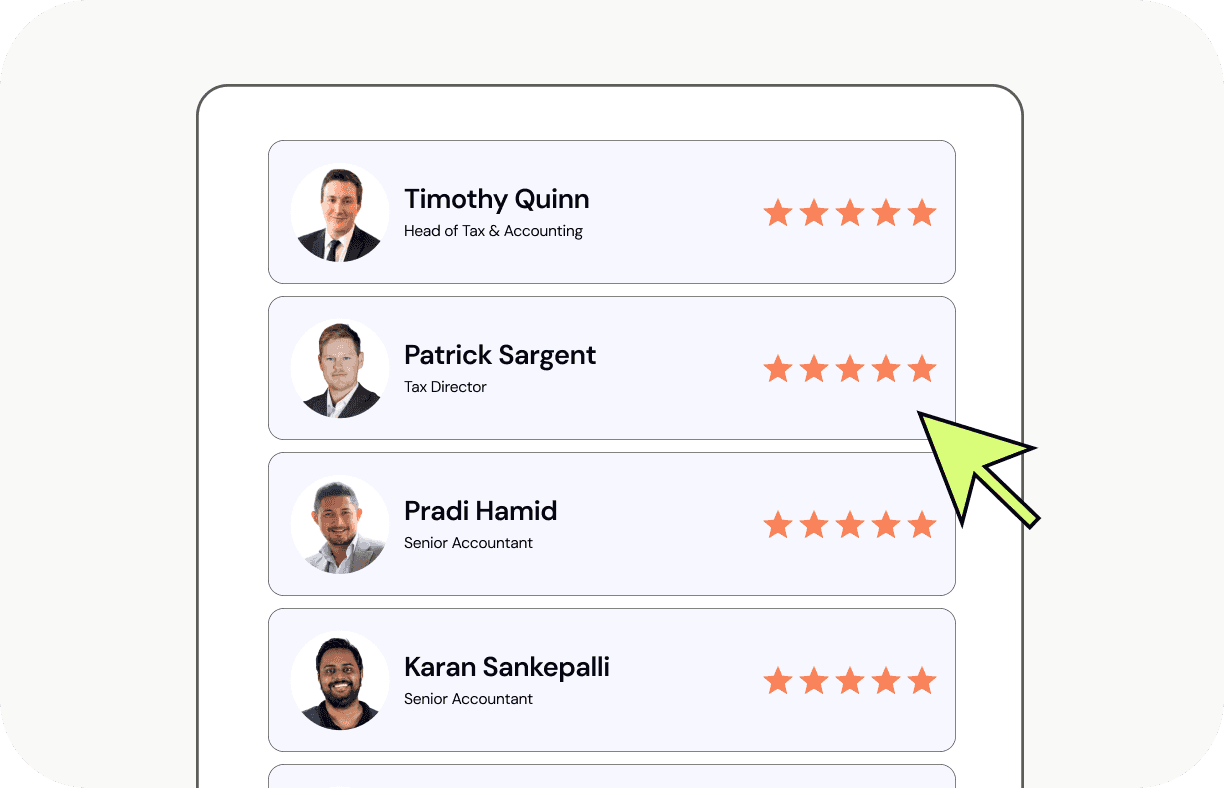

Every accountant at Lawpath holds current CPA or CA qualifications and is registered with the Tax Practitioners Board. They specialise in small business - not just compliance, but real advice you can act on. No jargon, no runaround, no waiting weeks for a callback.

Most accountants disappear after EOFY. At Lawpath, your accountant is available all year for unlimited consultations - tax planning, cashflow questions, structuring advice, anything. When a question comes up at 2pm on a Tuesday, you can book a call that week.

No obligation. Your information is protected under our privacy policy. A Lawpath accountant will respond within one business day.