Atlas connects to your tax and accounting data to surface upcoming lodgements, flag missed deductions, pre-build checklists, and tell you exactly what to pay, lodge, and plan for - before the deadline hits.

Capabilities

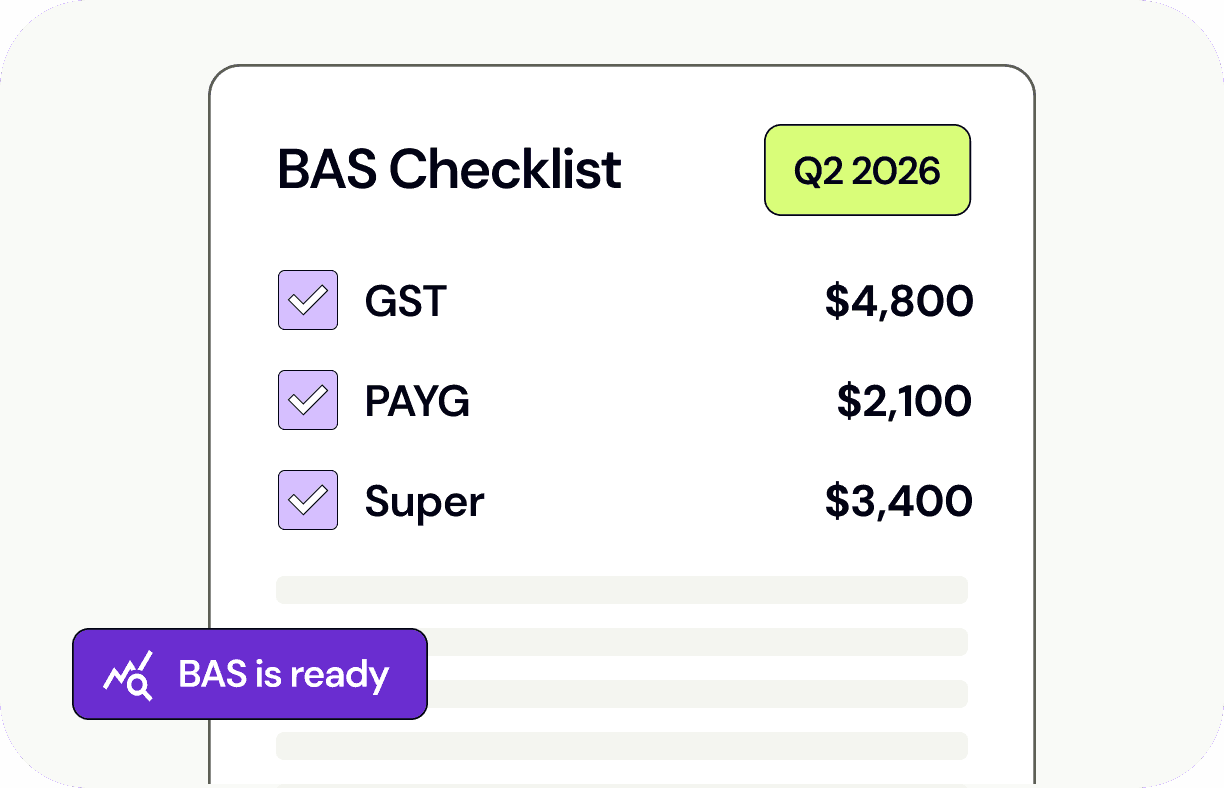

Atlas connects to your tax data to pre-calculate GST, PAYG, super obligations and income tax. It builds a complete checklist with pre-filled figures so you or your accountant can lodge with confidence.

Late lodgements, inconsistent reporting, unusual deduction patterns - Atlas monitors for the same red flags the ATO looks for and warns you before they become an issue.

Atlas projects your cashflow over the next 90 days, factoring in upcoming tax liabilities, BAS payments and super obligations. It recommends how much to set aside so you're never caught short.

Atlas detects governance triggers - new share issues, director appointments, structural changes - and prepares the required board resolutions, minutes and ASIC forms automatically.

Atlas compares your tax position, deduction ratios, and lodgement behaviour against businesses in the same industry, revenue band and structure.

BAS quarters, annual tax returns, super guarantee deadlines, PAYG instalments - Atlas tracks them all, sends reminders in advance, and tells you what's needed for each lodgement.

How it works

Atlas ingests data from your accounting system - invoices, expenses, payroll runs, bank feeds, P&L movements and balance sheet items. Everything is classified and reconciled automatically.

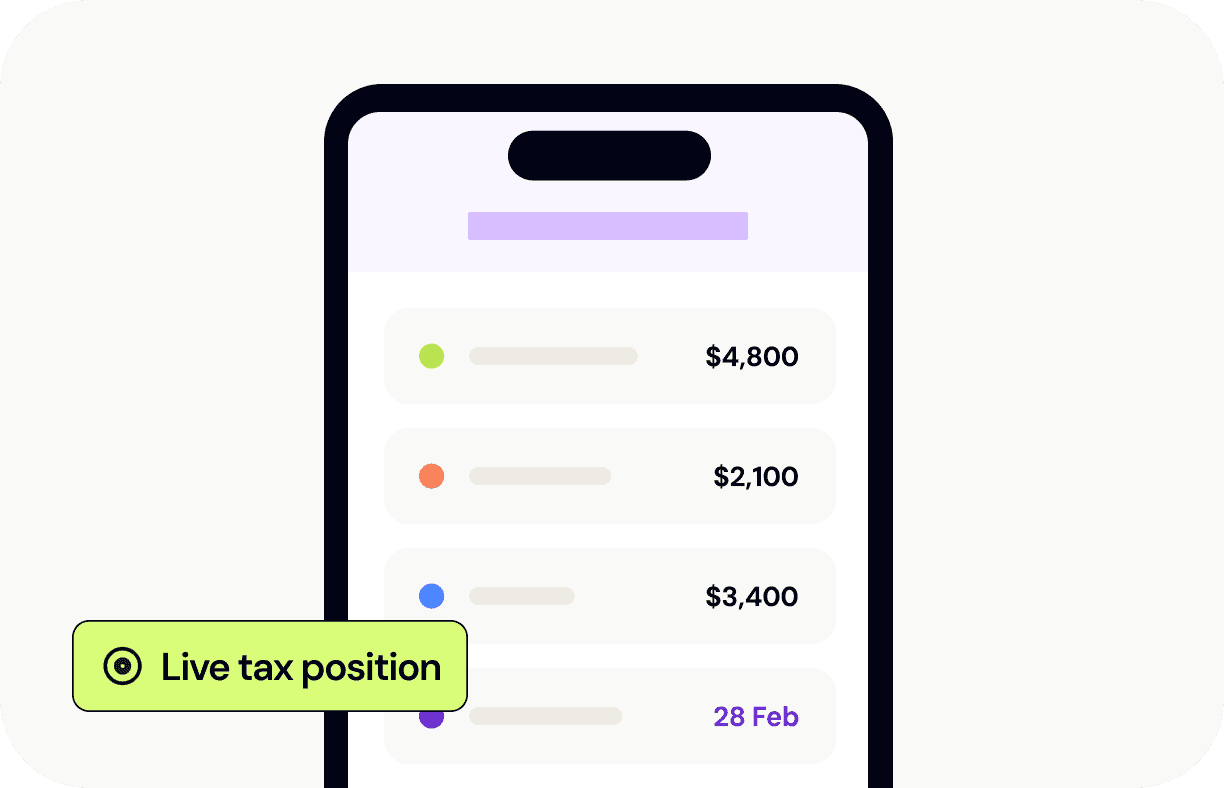

As your data changes, Atlas recalculates your GST position, PAYG withholding, super guarantee, and estimated income tax. You always have a live view of what's owed and when.

Atlas scans for missed deductions, unusual expense patterns, late payment risks, and cashflow pressure points. It compares your data to your industry peers and flags anything that looks off.

For each BAS period or tax return, Atlas builds a pre-filled checklist with specific "pay, lodge, plan" recommendations. For complex situations, it packages everything for your accountant.

Real-world scenarios

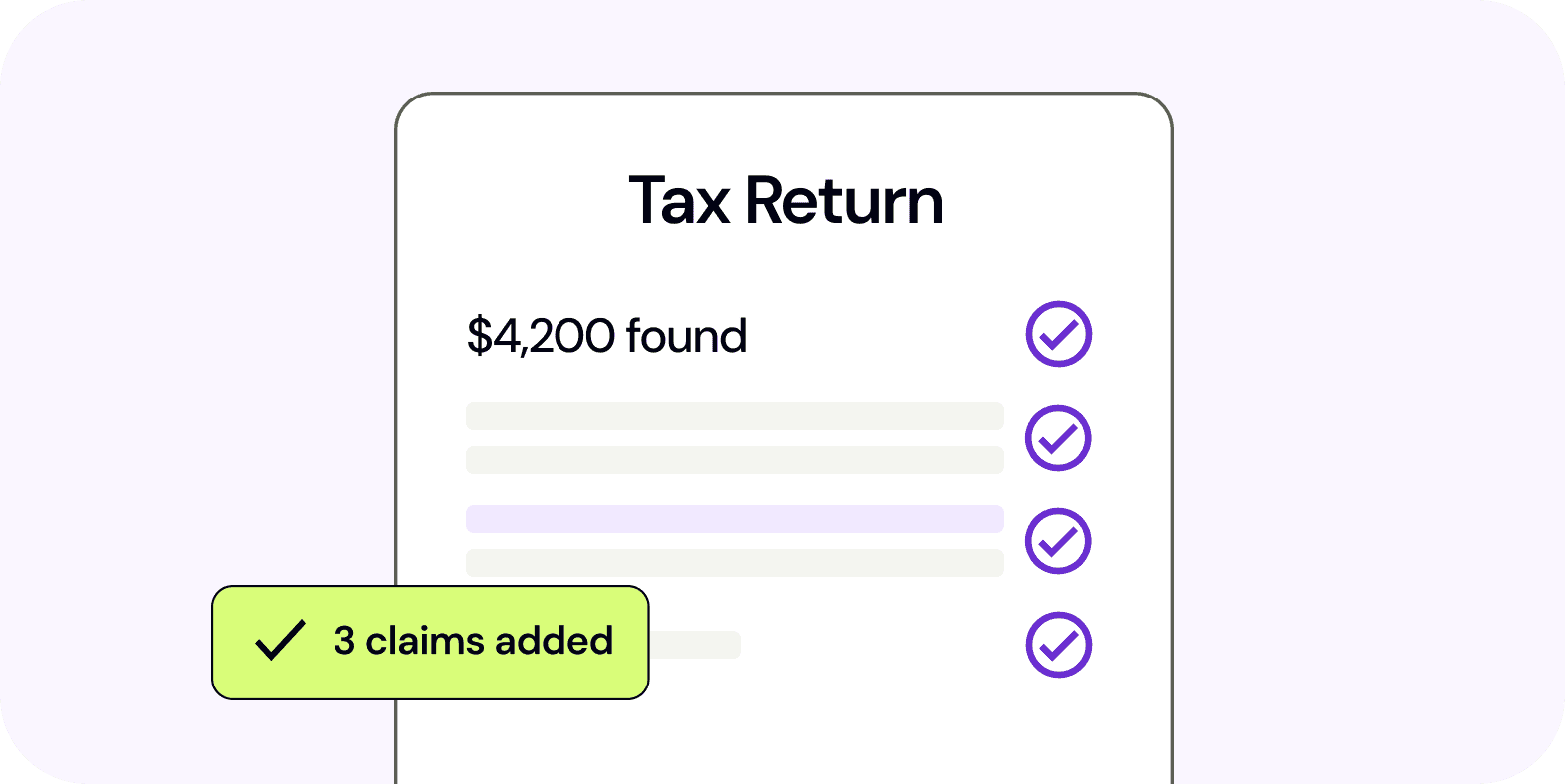

Missed deductions

Atlas reviews your expenses against common deduction patterns for your industry and finds $4,200 in home office, vehicle and equipment expenses that haven't been claimed..

BAS preparation

Two weeks before your BAS is due, Atlas has already reconciled your GST, calculated PAYG, checked your super obligations, and built a complete checklist.

Missed deductions

Atlas spots that your upcoming Q3 BAS and income tax instalment total $18,000 but your projected cash balance is only $12,000. It alerts you 8 weeks out and suggests setting aside $1,500 per week.

ATO risk

Atlas benchmarks your deductions against similar businesses and notices your travel expenses are 3x the industry average. It flags this as a potential ATO audit trigger and recommends you review with your accountant.

Get Started

Pre-built checklists, missed deduction alerts, cashflow projections and ATO risk monitoring - all running in the background. Included with every Lawpath plan.

Start your free trial