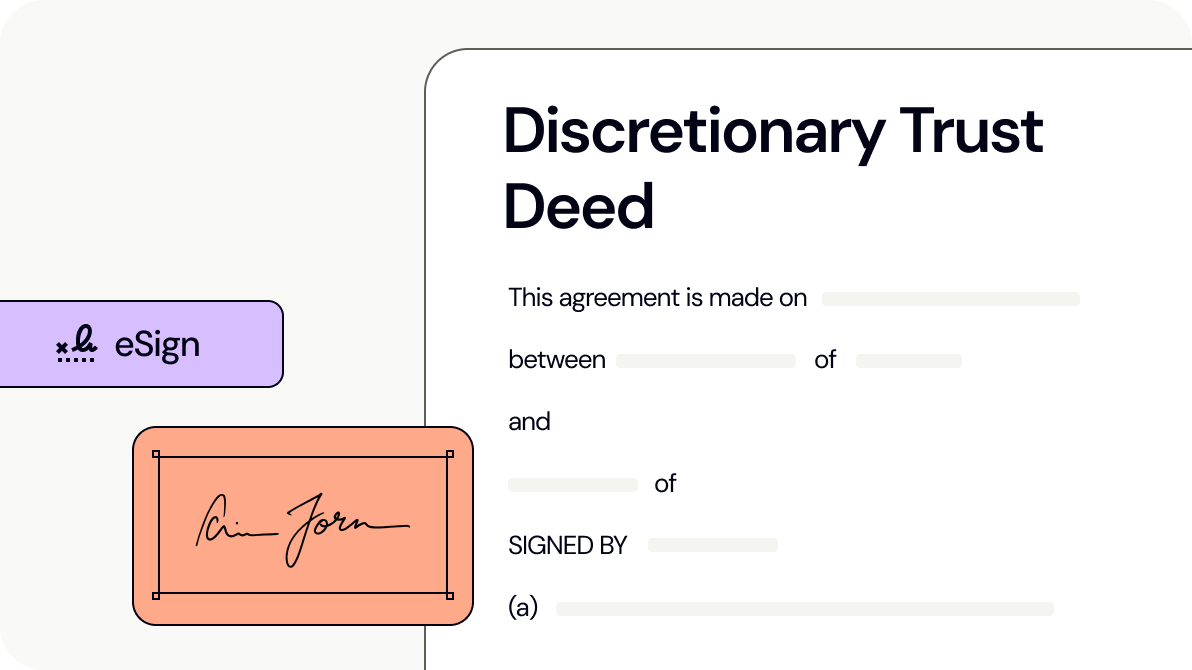

Discretionary Trust Deed

A Discretionary Trust Deed is used to establish a discretionary trust in any state or territory in Australia.

Last updated October 23, 2025

Suitable for Australia

Create & Customise Legal Templates Online

What is a discretionary trust deed?

What is a discretionary trust deed?

When should you use a discretionary trust deed?

When should you use a discretionary trust deed?

What should be in a discretionary trust deed?

What should be in a discretionary trust deed?

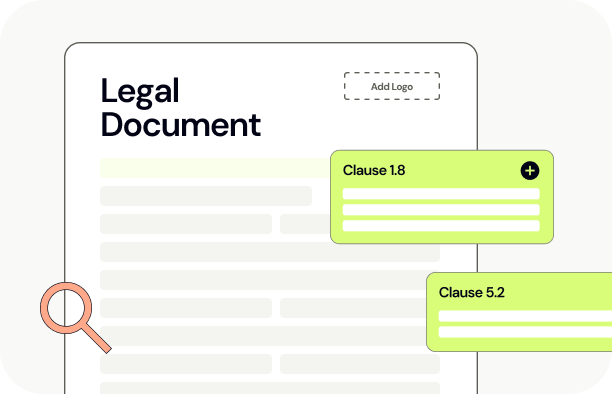

How to create a legal document

- check_circle

Access the Document Library

- check_circle

Select the template that matches your needs

- check_circle

Customise by adding or removing clauses with assistance from Lawpath AI

- check_circle

Personalise with your headers, footers, logos, or additional text

- check_circle

Store all documents securely in your account for easy access

Frequently asked questions

Who can act as trustee and are there restrictions?

keyboard_arrow_upWhat are the key benefits of using this document?

keyboard_arrow_upAre there any limitations or risks with this trust deed?

keyboard_arrow_upHow does this document address foreign beneficiaries and surcharges?

keyboard_arrow_upWhat practical steps are required after signing?

keyboard_arrow_upCan the trust be changed or updated after establishment?

keyboard_arrow_upWhat is the difference between a discretionary trust and a family trust?

keyboard_arrow_upView Sample Discretionary Trust Deed

The Legal Risk Score of a Discretionary Trust Deed Template is High

Our legal team have marked this document as high risk considering:

- Trust deeds must follow specific signing and witness procedures.

- Deeds often involve the distribution of assets of meaningful value and carry tax implications.

- There is little margin for error when drafting this document given the level of rights given to the trustee and beneficiary.

Meet Our Users

Articles about Discretionary Trust Deed

Looking for more documents?

Privacy Policy

A Privacy Policy outlines how your business will use, store and collect your customers' information. A Privacy Policy is required by law in certain circumstances.

Loan Agreement

This Loan Agreement can be used by lender when offering a loan to a Borrower.

Non-Disclosure Agreement (Mutual)

A Non-Disclosure Agreement (Mutual) allows you and another party to share confidential information while legally forbidding either party from disclosing that information to any other person or entity.

Will

A Will is an essential document as part of your estate plan. This Will cannot be e-signed.

Non-Disclosure Agreement (One Way)

A Non-Disclosure Agreement (One Way) allows you and another party to share confidential information while legally forbidding the other party from disclosing that information to any other person or entity.

Website Terms and Conditions of Use (Services)

This Website Terms and Conditions of Use (Services) document is specifically tailored for websites selling services.

Business Sale Agreement

A Business Sale Agreement is used to clearly set out all relevant terms of the sale when selling or buying a business.

Contractor Agreement (Individual)

The Contractor Agreement (Individual) allows you to hire a contractor that is an individual (ie. not a company).