Discretionary Trust Deed

A Discretionary Trust Deed is used to establish a discretionary trust in any state or territory in Australia.

Last updated October 23, 2025

Suitable for Australia

Browse our 500+ legal documents

Browse our 500+ legal documents

Manage documents, agreements and a lot more from one central place. Just log in and find everything ready to go.

Collaborate with e-Sign and Sharing

Collaborate with e-Sign and Sharing

Having access to your legal documents has never been easier. You can request e-signature, share the document and download for an efficient collaboration.

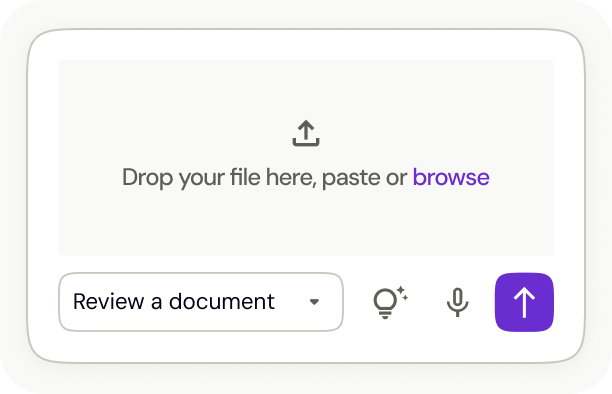

Instantly review any legal document

Instantly review any legal document

Upload your document, ask contract AI, and watch those burning questions transform into crystal-clear answers. Because brilliant decisions shouldn't keep you waiting.

How to create a legal document

- check_circle

Access the Document Library

- check_circle

Select the template that matches your needs

- check_circle

Customise by adding or removing clauses with assistance from Lawpath AI

- check_circle

Personalise with your headers, footers, logos, or additional text

- check_circle

Store all documents securely in your account for easy access

Frequently asked questions

Use this Discretionary Trust Deed if:

- You would like to establish a family trust; or

- You would like to gift property or moneys to be held on trust.

What does the Discretionary Trust Deed cover?

- Establishing the trust;

- Defining the relevant beneficiaries;

- Distribution of income and capital to the beneficiaries;

- Winding up of the trust;

- Appointment of the trustee, including powers, remuneration;

- Removal and appointment of future trustees;

- Responsibility for financial records; and

- A relevant indemnity

Should a lawyer review my Discretionary Trust deed?

To properly take advantage of a discretionary trust, it is necessary to obtain sound legal and tax advice. There are various implications that can result from incorrect drafting of a deed, so it is very important to seek legal advice to ensure that your trust is set up correctly in order to maximise security and protection.

What is the difference between a custodian and a trustee?

A trustee is a person who has a fiduciary duty to hold assets on trust for the benefit of another. Whereas a custodian is not a fiduciary and is only responsible for the safekeeping of the assets, not the distribution. A custodian does not provide investment advice or have any sway in how the assets within the trust are to be invested, unlike a trustee.

What is the difference Between a Discretionary Trust and a:

Testamentary trust

A discretionary trust is established by the person who sets up the trust, trustee, and the trustee has the power to choose the amount of money that will be paid to each beneficiary under the trust. A testamentary trust that is set up through your will and will not come into effect until you have passed away. The benefit of setting up this type of trust is that access is only granted once you pass away, which is useful if you have young children or loved ones who may not be able to manage their inheritance appropriately. The main difference between the two is the fact that a testamentary trust only comes into effect once the trustee passes away. An advantage of setting up a Testamentary Trust is that you can decide how the assets in the trust are to be managed by the beneficiaries, such as limiting spending per year and the amount dedicated for the beneficiaries education.

Family Trust

A discretionary trust is established by the person who sets up the trust, trustee, and the trustee has the power to choose the amount of money that will be paid to each beneficiary under the trust. Whereas a family trust refers to a trust that is generally set up to benefit a family business or member of the family included in the trust. A family trust is discretionary trust that is set up to hold a family’s assets or to conduct a family business through a trust. The key in forming a family trust is holding a “Family Trust Election,” which officially enables the trust to become a family trust.

Further information

View Sample Discretionary Trust Deed

The Legal Risk Score of a Discretionary Trust Deed Template is High

Our legal team have marked this document as high risk considering:

- Trust deeds must follow specific signing and witness procedures.

- Deeds often involve the distribution of assets of meaningful value and carry tax implications.

- There is little margin for error when drafting this document given the level of rights given to the trustee and beneficiary.

Articles about Discretionary Trust Deed

Looking for more documents?

Privacy Policy

A Privacy Policy outlines how your business will use, store and collect your customers' information. A Privacy Policy is required by law in certain circumstances.

Loan Agreement

This Loan Agreement can be used by lender when offering a loan to a Borrower.

Non-Disclosure Agreement (Mutual)

A Non-Disclosure Agreement (Mutual) allows you and another party to share confidential information while legally forbidding either party from disclosing that information to any other person or entity.

Will

A Will is an essential document as part of your estate plan. This Will cannot be e-signed.

Non-Disclosure Agreement (One Way)

A Non-Disclosure Agreement (One Way) allows you and another party to share confidential information while legally forbidding the other party from disclosing that information to any other person or entity.

Website Terms and Conditions of Use (Services)

This Website Terms and Conditions of Use (Services) document is specifically tailored for websites selling services.

Business Sale Agreement

A Business Sale Agreement is used to clearly set out all relevant terms of the sale when selling or buying a business.

Contractor Agreement (Individual)

The Contractor Agreement (Individual) allows you to hire a contractor that is an individual (ie. not a company).