Introduction

Small businesses employ over 5.1 million people in Australia; they are the backbone of the Australian economy in response to contributing immensely to economic growth. In this article, we will be going into all things related to small businesses: employment, industries, failure rates, and the aspects of business operations that drive growth and change. Small businesses. In this comprehensive exploration of small businesses in Australia, we aim to shed light on the intricate web of factors that shape their existence, growth, and challenges in an ever-evolving economic landscape.

Table of Contents

Definition of Small Businesses

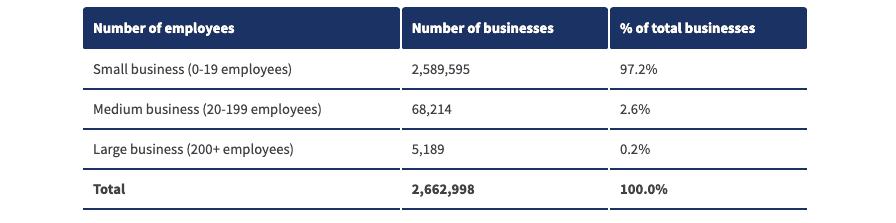

Most information on small businesses in Australia is provided by the Australia Bureau of Statistics (ABS). The Australian Bureau of Statistics (ABS) defines small businesses in Australia as businesses that employ less than 20 people. Small businesses include:

- Sole proprietors and partnerships (one or multiple owners without employees)

- Micro-businesses (1 to 4 employees)

- Any other business that has between 5 to 19 employees.

The Australian Taxation Office (ATO) uses the turnover of businesses as a guideline to define what a small business is, claiming a business with less than $2 million in aggregated turnover constitutes a small business.

Small Businesses: The Backbone of the Australian Economy

With 2,589,595 in total, small businesses in Australia make up 97.2% of all businesses in Australia, making these businesses key stakeholders in upholding Australian employment and economic prosperity.

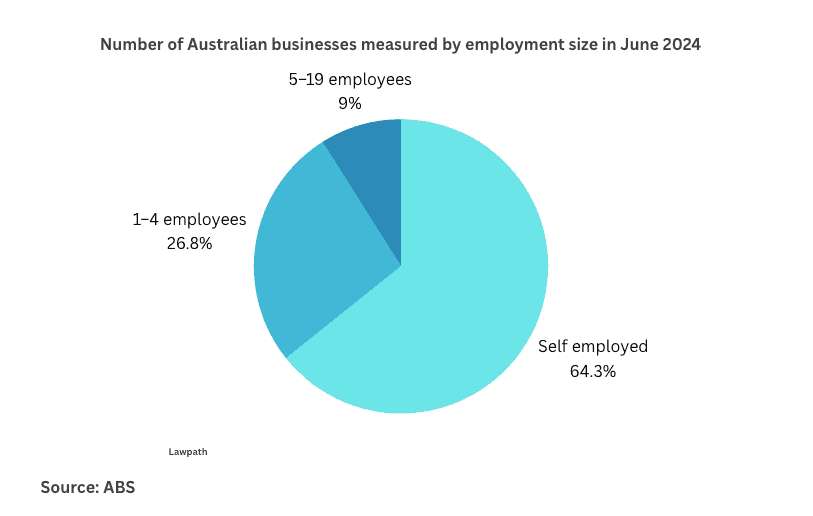

It’s important to note that small businesses in Australia also encompass sole traders who, under business organisation legislation, are considered ‘self employed’.

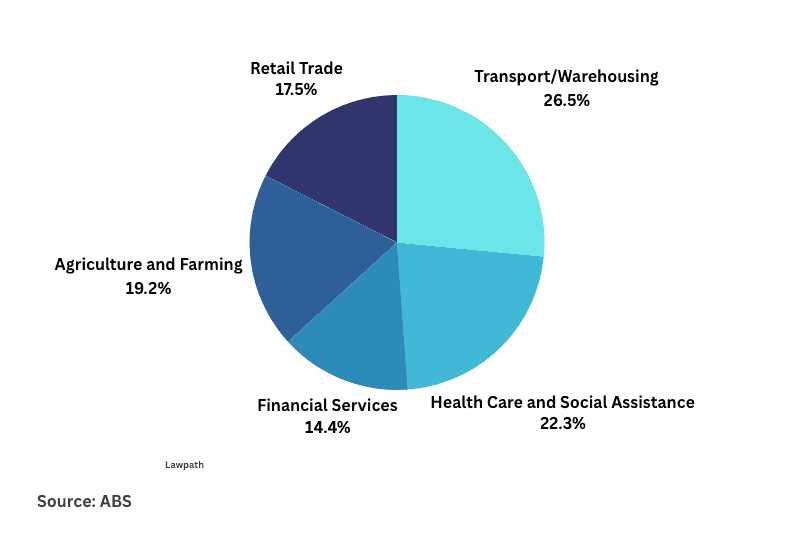

Small Businesses: Industries

Majority of small businesses in Australia operate in the transport/warehousing industry, followed by retail and health care.

Businesses: Employment

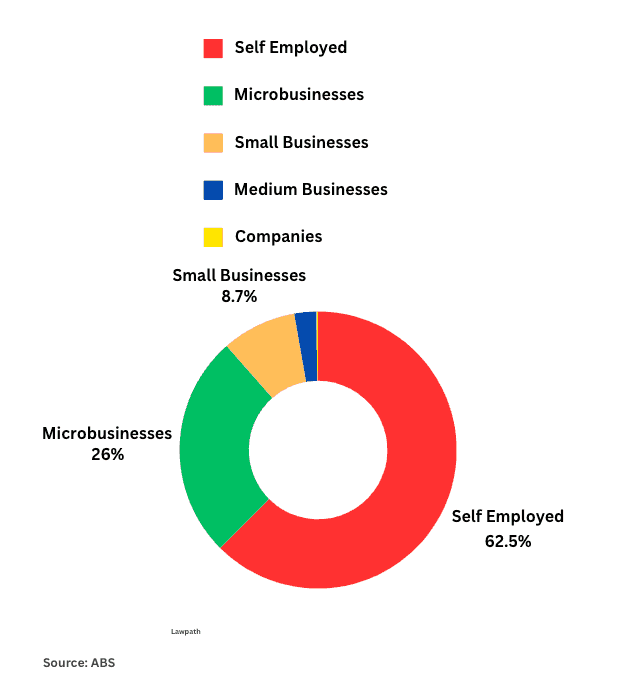

In Australia, the majority of the workforce are employed under small-to-medium enterprises. It is important to note that self employed individuals, microbusinesses and small businesses have been broken down to demonstrate the share they have in relation to employment.

Annual Employment Change

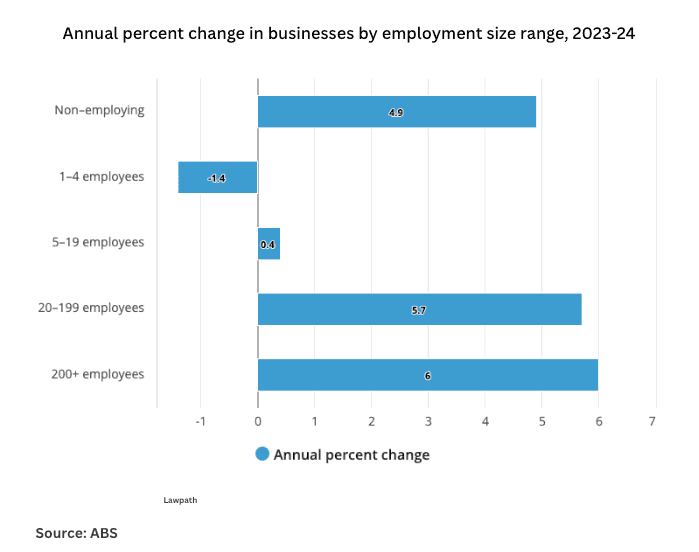

From 2023 to 2024, there has been a small increase in small businesses that are not considered microbusinesses or self employed individuals, increasing by 0.4%.

Businesses: Industries and Profitability

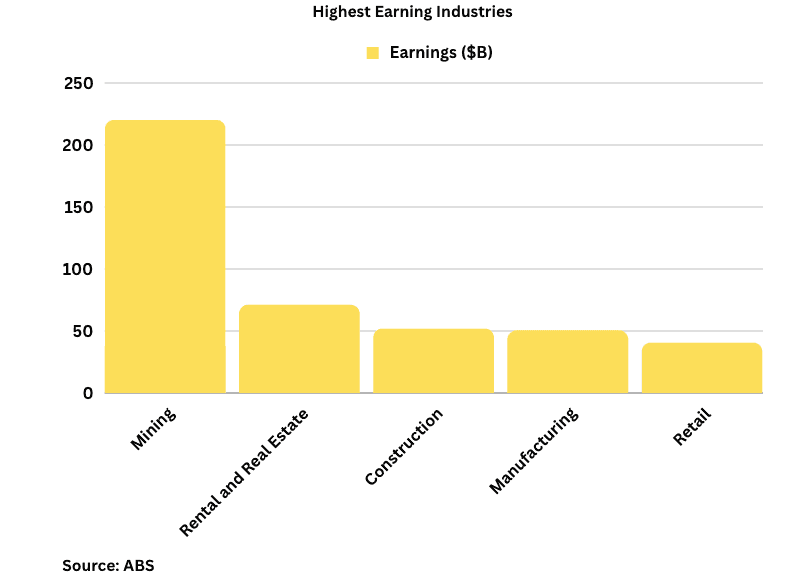

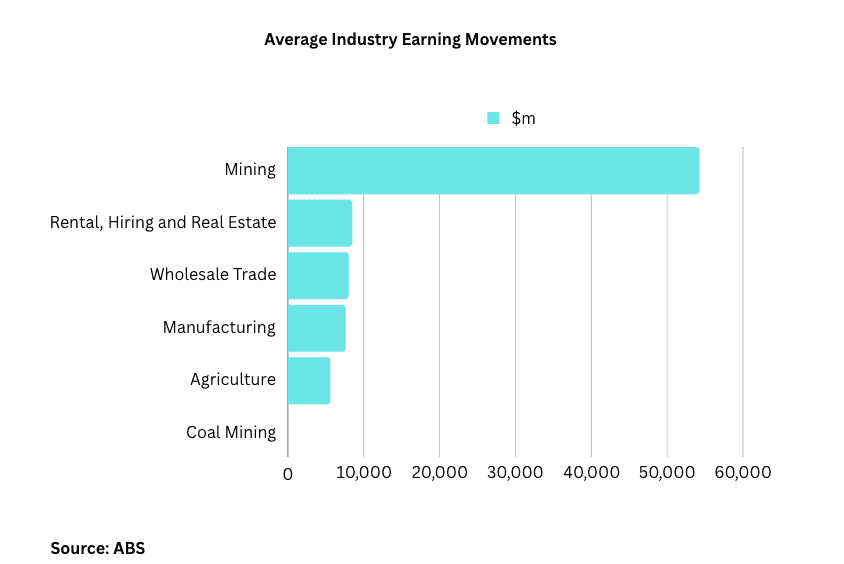

As of 2024, the mining industry has the highest earnings of all sectors within Australia and generates significantly more earnings than any other industry followed by rental and real estate services and construction. Before starting a business, it is important to develop an industry analysis in order to prevent business failure.

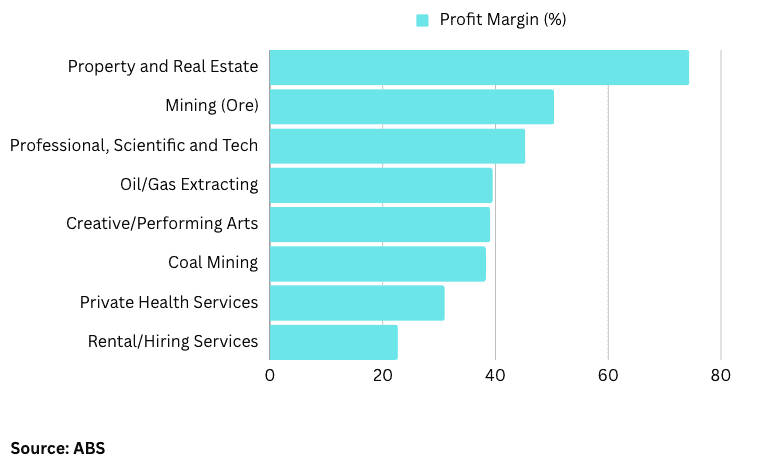

The most profitable industry in Australia is the property and real estate sector, followed by ore mining. The basis for the real estate industry having the highest profit margin is in response to factors such as an increase of demand for houses and overseas migration

Small Businesses: Entry/Exit Rates

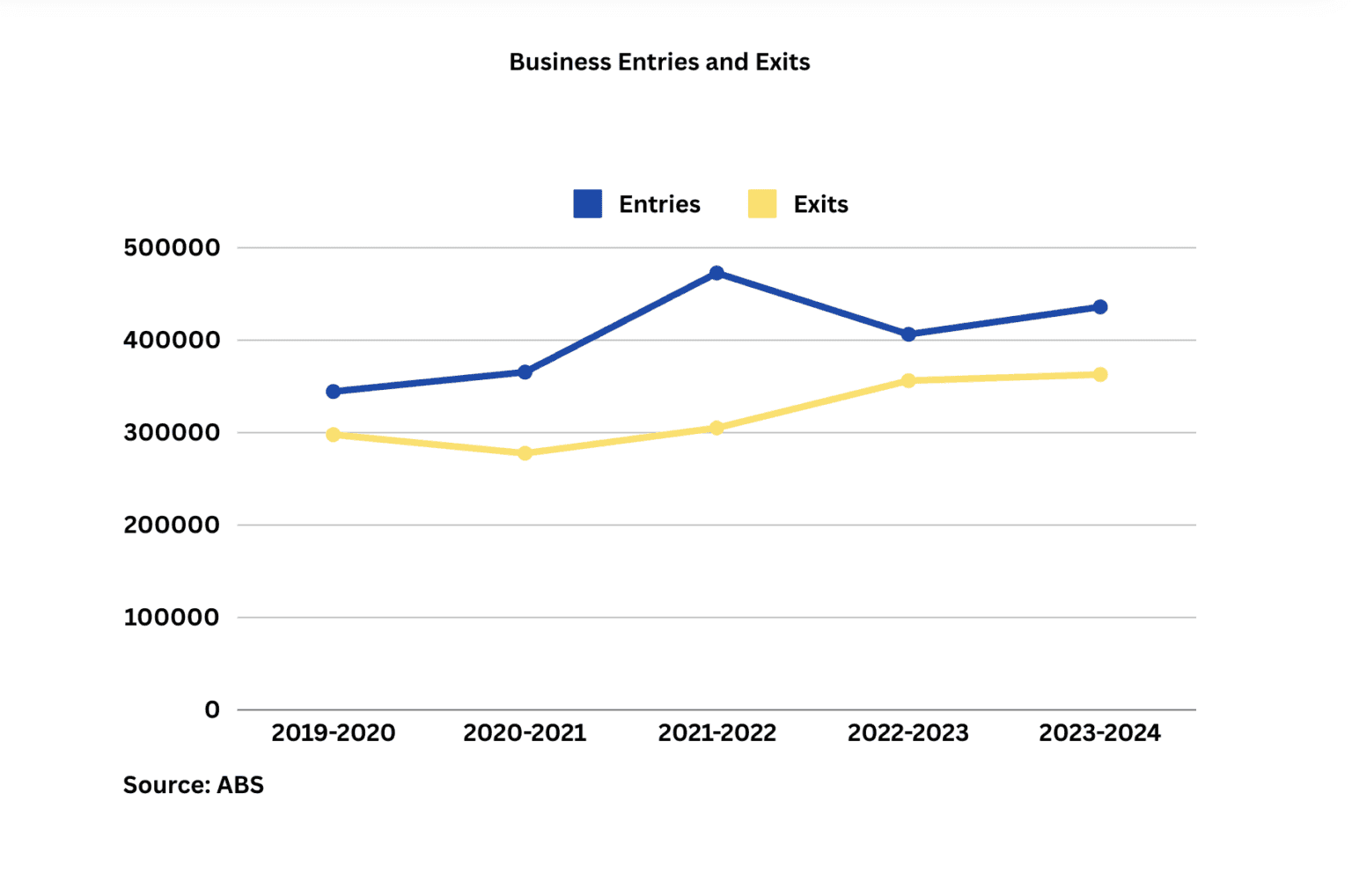

60% of businesses in Australia will fail within their first three years of operation, with 20% of businesses failing in their first year of operating. Whilst the exit rate of businesses in Australia is extremely high, developing an exit strategy for your business can assist in minimising financial detriments.

As of the last financial year, from 2023 to 2024, there have been an average of 436,018 entries and 362,893 exits.

According to the Australian Banking Association, the reasons for small business failure include:

- Insufficient leadership and management.

- Inadequate market research.

- Poor financial management.

- Underestimating competitors.

- Product and services issues.

Growth in Industires

In response to industrial expansion and rising middle-class incomes, there has been a constant and increasing demand for mineral and energy consumption which has led to mining businesses generating the highest average earnings of all businesses.

Geographic Location

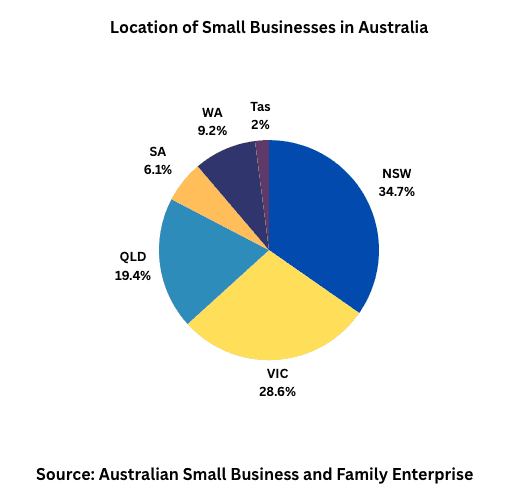

Over the past year, small businesses have increased by 7%. As of 2024, most small businesses operate in New South Wales, Victoria, and Queensland.

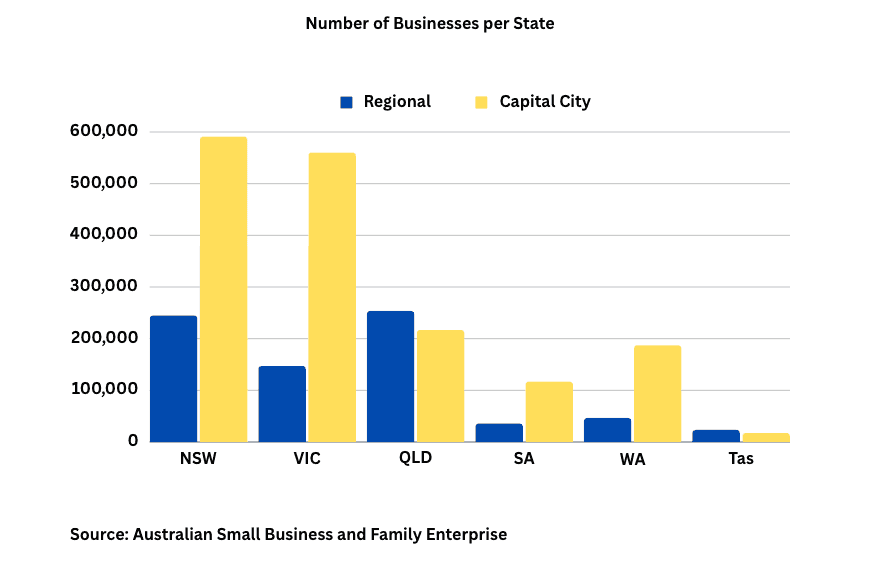

The geographic location of businesses can be vital to success.

The capital city of states in Australia are usually triple the amount of those businesses operating in regional areas.

Conclusion

Overall, small businesses have an imperative role in the Australian economy. Making up the largest portion of businesses in Australia, small businesses have a vital role in employment, industry operations, and economic growth. There are various factors that determine the failure and/or success of a business with these enterprises operating in both metropolitan and geographical areas.