Many business owners find company tax rate calculations confusing, mistaking which rate applies or how deductions affect taxable income. This can lead to a higher-than-necessary tax bill and even issues with the Australian Taxation Office (ATO).

There are two primary tax rates for Australian companies: 25% for eligible base-rate entities (small to medium-sized companies) and 30% for all other companies. Determining your company’s eligibility for the lower 25% tax rate is critical to optimising your tax position.

In this article, we’ll walk you through the ins and outs of the Australian company tax system by breaking down current tax rates, the calculation method, common deductions and offsets, key deadlines, and practical tax management tips.

By the end, you will have a clearer grasp of how company tax is calculated in Australia and useful strategies to manage your obligations efficiently.

Table of Contents

Current Australian company tax rates

A company is a type of business structure under the Corporations Act 2001 (Cth). One of the main characteristics of a company is that it is a separate legal entity, which operates independently of the people who create it. That is, unlike a sole trader, where the business owner carries all responsibility, a company can be sued or incur debt.

In Australia, for the 2024-25 income year (and continuing into 2025-26), taxable companies face one of two tax rates:

- A 25% tax rate for base-rate entities, which applies to companies that meet the following criteria:

- Have an aggregated turnover of less than $50 million in the income year.

- Have no more than 80% of their assessable income from passive income sources such as dividends, interest, rent, royalties, and net capital gains.

- A 30% tax rate for all other companies, including those exceeding the turnover threshold or with higher passive income proportions.

Base-rate entity criteria

A base rate entity is defined based on both turnover and income composition tests. Essentially, it receives a special company tax rate for small businesses.

The goal of using strict criteria is to ensure that the reduced 25% rate is available to genuine small to medium businesses actively engaged in operations, rather than primarily relying on passive investments.

Here is a quick summary table on eligibility criteria:

| Tax Rate | Turnover Threshold | Passive Income Limit | Example Businesses |

| 25% | Less than $50 million | ≤ 80% of total income | Small tech startups, retail shops, and manufacturing SMEs |

| 30% | No turnover limit | Not applicable | Large corporations, investment companies, and high passive income businesses |

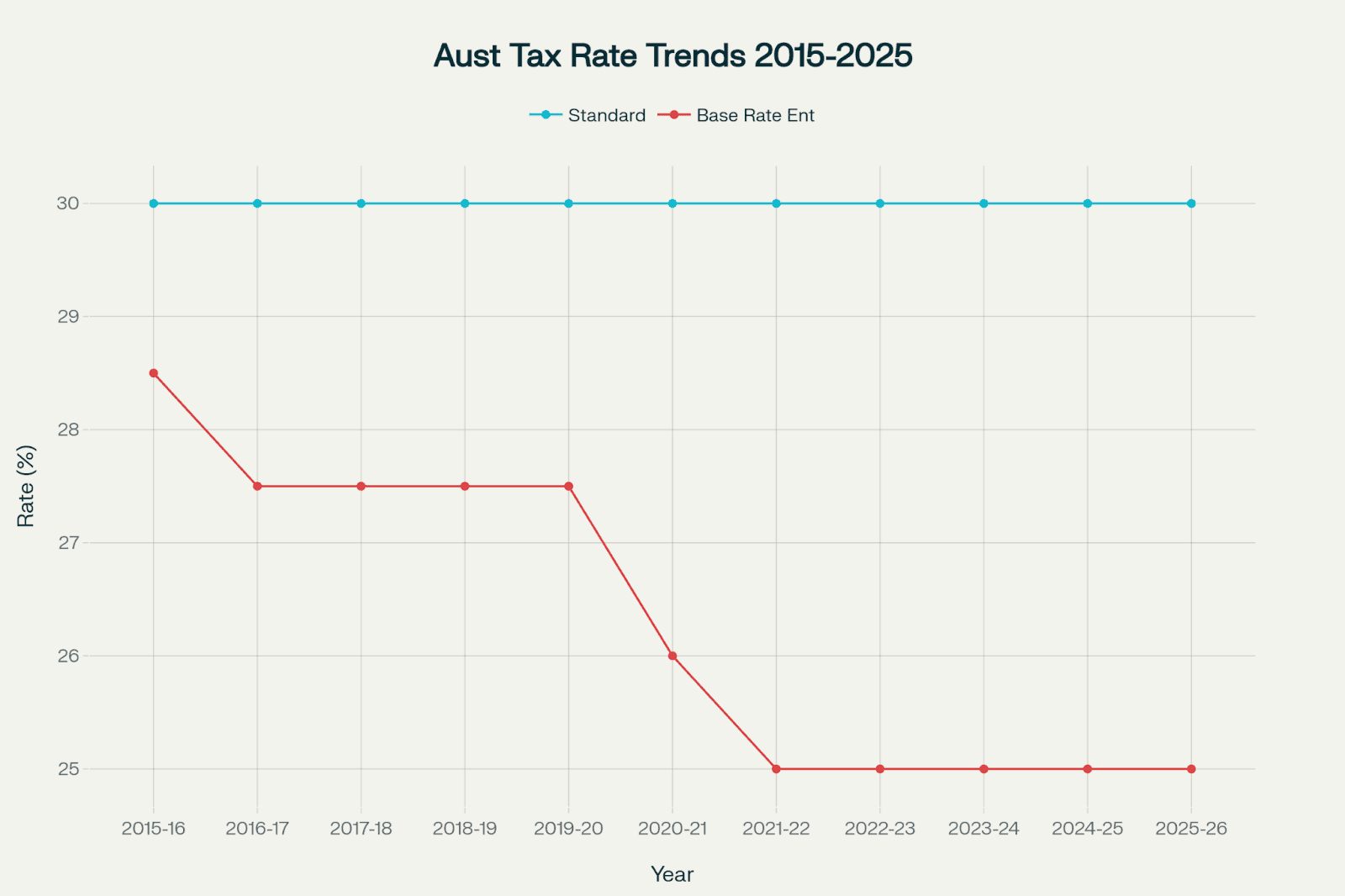

The graph below showcases how company tax rates in Australia have changed over the past 10 years, highlighting a gradual decrease for base-rate entities. This reflects government policy shifts aimed at supporting smaller businesses. The standard rate for all other companies has remained steady at 30%.

Source: https://www.ato.gov.au/tax-rates-and-codes/company-tax-rates

This official ATO page provides the current company tax rates and thresholds for reference.

How company tax is calculated

The basic formula for calculating company tax in Australia is: Assessable Income – Allowable Deductions = Taxable Income

Then, you simply apply the relevant tax rate based on your company’s eligibility, so either 25% or 30%.

Let’s take a look at a step-by-step example.

Suppose a small business that qualifies as a base rate entity has:

- Assessable income for the year: $1,000,000 (of which only $100,000 is passive)

- Allowable deductions (operating expenses, salaries, depreciation, etc.): $400,000

Calculation:

- Taxable income = $1,000,000 – $400,000 = $600,000

- Apply the 25% tax rate = $600,000 × 25% = $150,000 company tax liability

The final amount payable is $150,000.

Companies that do not qualify as base-rate entities simply apply the 30% rate instead.

Here is a simplified flowchart of the tax calculation process:

Income ➔ Deduct allowable expenses ➔ Calculate taxable income ➔ Multiply by tax rate (25% or 30%) ➔ Final tax payable

For practical use, the ATO offers a company tax calculator and detailed tax return instructions to assist companies in calculating their tax correctly.

Common deductions and offsets for companies

Deductions are expenses you can use to lower your assessable income. The result is your taxable income.

Generally, for an expense to be a deduction, it needs to fulfil the following criteria:

- The expense represents business use and not personal use; or

- The expense is for something used partially for business and partially for personal use. In this situation, you can only deduct the portion that was for your business, and

- You can prove these expenses.

Here are some typical deductions that most small businesses can claim:

- Business travel expenses

- Operational costs

- Capital expenditure (either immediately or depreciated over time, depending on the circumstances)

- Professional services

- Sales and marketing

- Maintenance and repairs

- Salaries and wages

Remember that there are certain expenses that you cannot claim. These include:

- Personal or household expenses (unless you use your home as a home office)

- Fines and tickets

- Personal spending of any kind

- If you’ve already claimed the GST portion of a purchase in your business activity statement, you can’t claim that portion as deductible.

In effect, the amount you spend on deductible expenses is then taken out of your assessable income. The result is taxable income.

For instance, say your online business makes $20,000. You spent $1,000 on deductible expenses like business travel. In that case, your taxable income is $19,000. If you have a regular company and no other factors apply, the tax rate is 25%. Therefore, your tax for that year would be $4,750.

Here is an at-a-glance summary of different deduction types and eligibility to claim them:

| Deduction/Offset | Eligibility | Example |

| Operating expenses | All companies with legitimate business costs | Rent paid for office space |

| Salaries and wages | Paid to employees for company operations | Payroll for full-time staff |

| Depreciation | Companies owning depreciable assets | Depreciating cost of machinery |

| Interest expenses | On business-related loans | Interest on a loan taken for equipment |

| Small business income tax offset | Unincorporated small businesses with a turnover <$5 million | Sole trader claiming an offset of up to $1,000 |

The ATO provides detailed guides on claiming deductions and industry-specific checklists to help businesses ensure they claim all legitimate expenses.

Key deadlines and how company tax is paid

Beyond paying the correct rate, you need to be aware of tax payment deadlines and compliance requirements to avoid penalties.

- The annual company tax return deadline typically falls on February 28th following the end of the income year (May 15th if you use a Registered Tax Agent like Lawpath Tax & Advisory), though dates vary depending on lodgement methods, compliance history and extensions.

- Pay As You Go (PAYG) instalments: Companies often pay tax in instalments throughout the year based on prior income to spread liability.

- You can lodge returns and payments electronically via the ATO’s online services or approved tax agents.

A typical tax cycle timeline looks like this:

| Time of Year | Key Action |

| July 1 – June 30 | Income year |

| October | First quarter PAYG instalment payable |

| February 28(following year) | Tax return and balance payment due |

Keeping track of these deadlines with reminders or software helps ensure timely compliance.

Practical tips to manage company tax

To optimise your company tax obligations effectively, here are practical strategies with clear steps on how to implement each.

Prepay expenses near year-end to increase deductions

You can prepay expenses before the end of the financial year to bring forward deductions into the current tax year. This helps to almost immediately lower your company’s taxable income.

The expenses can include costs like rent, insurance premiums, subscription fees, or business-related services that you expect to incur in the next 12 months.

How to do it:

- Review upcoming expenses that you can legitimately prepay.

- Make payments before June 30th to claim them as deductions this financial year.

- Ensure these prepayments comply with ATO rules. For small business entities, prepaid expenses for services extending no more than 12 months after payment and ending within the next income year are deductible.

- Keep records of the payments and the related contracts or invoices to substantiate your claims.

Use instant asset write-offs for eligible asset purchases

The instant asset write-off allows eligible businesses to immediately deduct the full cost of each asset purchased up to a specific threshold instead of depreciating it over several years. For the 2025-26 income year, businesses with a turnover under $10 million can claim immediate deductions for assets up to $20,000.

How to do it:

- Identify assets your business needs to purchase (e.g., equipment, machinery, vehicles) before June 30th.

- Ensure your business turnover qualifies (under $10 million).

- Acquire and install the asset within the financial year to claim the instant write-off.

- Keep detailed purchase and installation records to support your deduction claim.

Maintain accurate and organised records for all income and expenses

Accurate bookkeeping is essential to claim all legitimate deductions, avoid disputes with the ATO, and prepare accurate tax returns.

While there are small expenses you can claim without a receipt, well-organised records make it easier to monitor cash flow, prepare financial reports, and justify your tax position if audited.

How to do it:

- Use accounting software or hire professional bookkeepers to track income and expenses regularly.

- Retain receipts, invoices, bank statements, and payment confirmations for all business transactions.

- Reconcile accounts monthly to catch errors or missed deductions early.

- Store digital or physical records securely for at least five years, as required by law.

Consult with tax professionals to navigate complex rules or new legislation

Tax laws and eligibility criteria change frequently and can be complex. Professional advice helps optimise your tax position, ensure compliance, take advantage of all available concessions, and avoid costly mistakes.

How to do it:

- Engage a qualified accountant or tax advisor experienced in Australian company tax.

- Schedule regular tax planning reviews to discuss changes in your business or tax law.

- Use their expertise for year-end tax strategies, lodgement assistance, and ATO communications.

- Leverage tax professionals for strategic advice on corporate structuring, asset purchases, and timing of deductions.

These proactive strategies are designed to legitimately reduce your company’s taxable income and improve cash flow management.

FAQ

How do I know if my company qualifies for the lower rate?

You qualify for the 25% tax rate if your company’s turnover is under $50 million and no more than 80% of your assessable income comes from passive sources like dividends and interest. This is reassessed every year.

Can I calculate company tax myself?

Yes, you can calculate company tax yourself by deducting allowable expenses from assessable income to find taxable income, then applying the correct tax rate. The ATO also provides tools and guides to help you do this, although we recommend using a professional registered tax agent such as Lawpath Tax & Advisory because of the complexity.

Ensuring business tax compliance in Australia

Understanding how company tax is calculated in Australia — from current rates to deductions and payment deadlines — is essential for any business owner. Navigating ATO rules correctly can save money and avoid penalties.

But, ensuring business tax compliance can be nerve-wracking and confusing. For tailored advice and easy access to tax compliance tools, reach out to Lawpath. We simplify the complexities of business tax obligations for Australian companies.