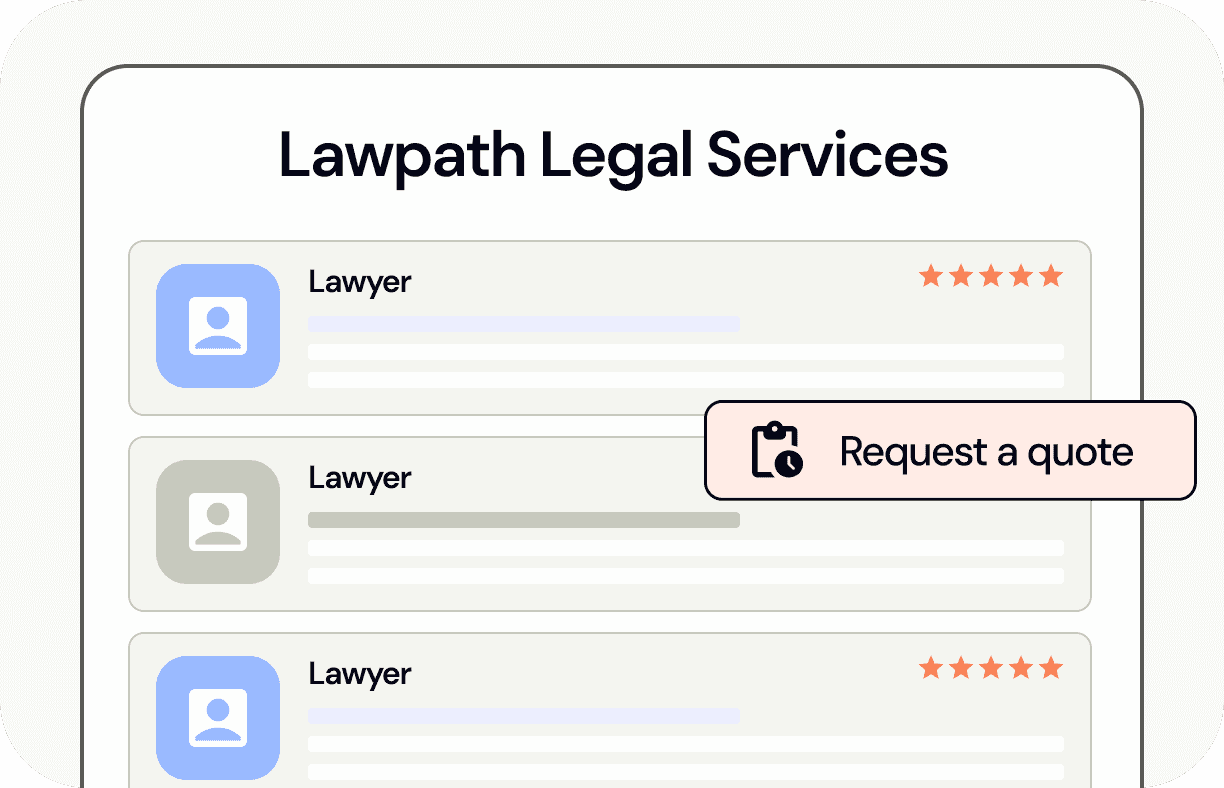

Request a free quote and find the perfect lawyer for your needs.

Verified reviews by

Verified reviews by

Verified reviews by

Connecting with your lawyer is easy with our online platform. You can reach quoting lawyers directly via phone or instant message, ensuring your queries are addressed swiftly and efficiently. We'll ensure that your legal needs are met without any delays and hassle.

Our lawyers bring extensive experience across various commercial practice areas. We'll help you find a practical and tailored solution and connect you with a lawyer who is well-equipped to handle your specific needs.

When it comes to Australian businesses, we've seen it all and solved it all. With a proven track record, we'll help you move ahead with confidence so you can get back to growing your business.

Connect with lawyers on the go, available at any time and on any device to ensure you have access to expert advice whenever you need it. With just a few clicks, you can edit your request and effortlessly reengage with your lawyer, making ongoing communication smooth and hassle-free.

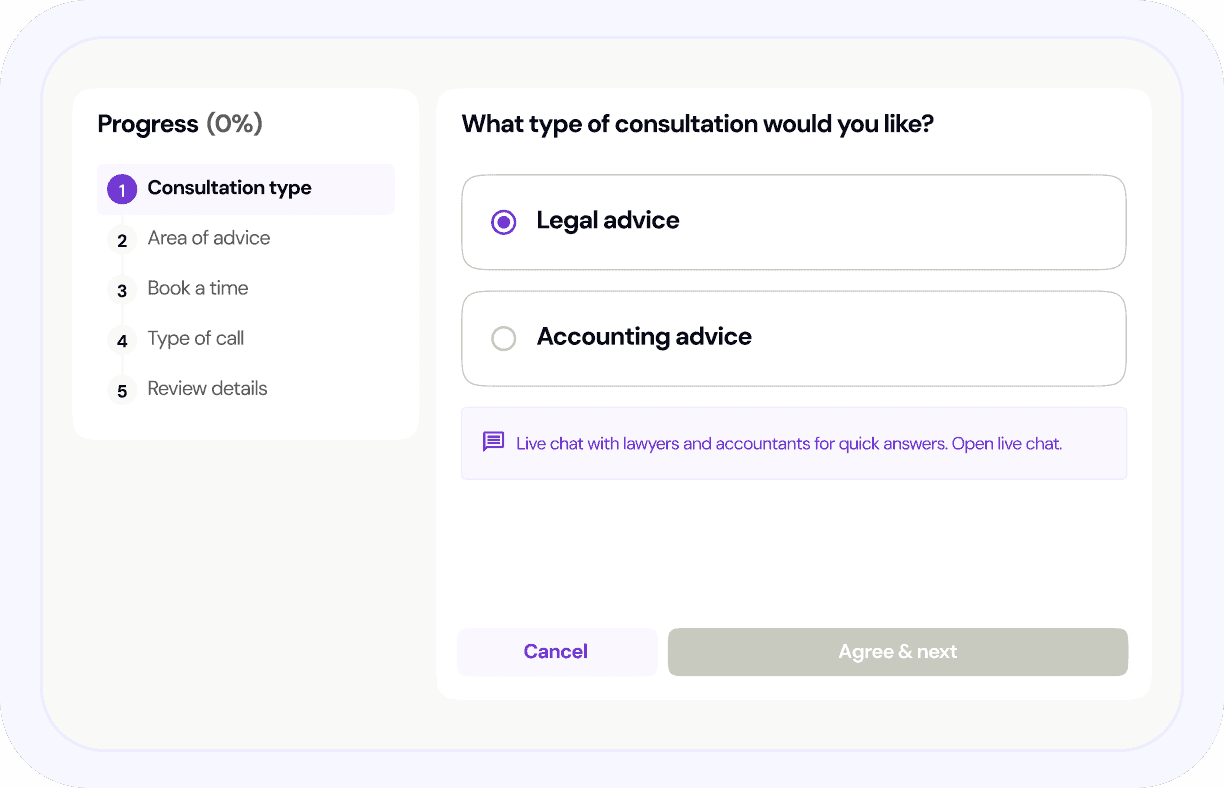

Set up a free Lawpath account and tell us what you need via an easy online form

We’ll generate a free, verified quote based on your needs

Hire the best lawyer for your business

A debt collection lawyer is a legal professional who specialises in assisting creditors, financial institutions, businesses, and individuals in recovering unpaid debts. These lawyers handle various aspects of debt recovery services, from negotiating repayment plans to pursuing legal actions against debtors. Their primary goal is to ensure that creditors recover outstanding debts while adhering to relevant laws and regulations.

Brisbane's workforce participation rate is higher than the national average. Small businesses are essential to the city's economy, employing a significant portion of the workforce and contributing substantially to the local economy. The professional, scientific, and technical services sectors are among the top employers, highlighting the importance of skilled professionals in Brisbane's economy. In this highly competitive environment, it’s important to make sure that you are proactive in addressing issues regarding your loans.

Debt collection lawyers in Brisbane offer a range of services to help creditors recover debts efficiently and legally. These services include:

Principal Lawyer

Our experts are here when you need them. Clear advice, no pressure.

Our support and sales teams are available to take your call at any time between 9:00am to 6:00pm from Mondays to Fridays.