Everything a new business owner needs, professional advice, compliance support, and smart tools — all in one simple plan.

Get access to a dedicated business consultant who'll walk you through your setup, review your registrations, and make sure everything is structured correctly from the start.

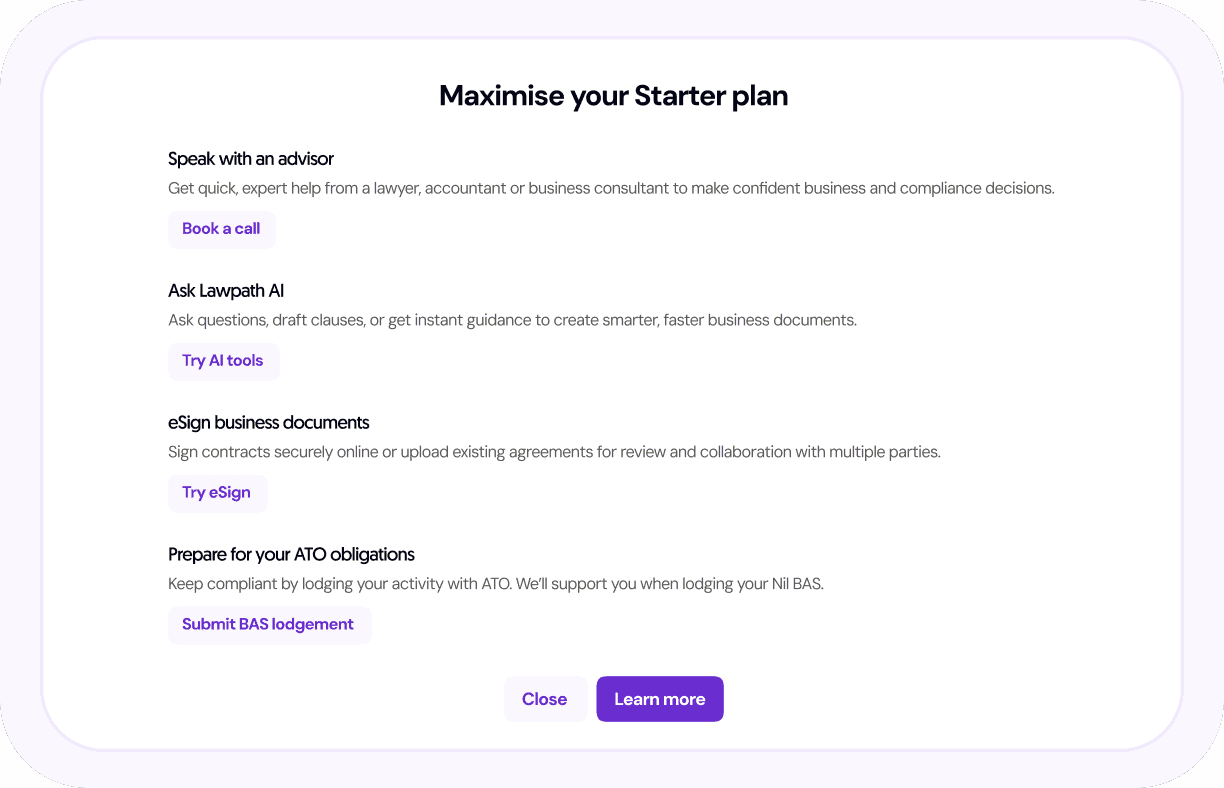

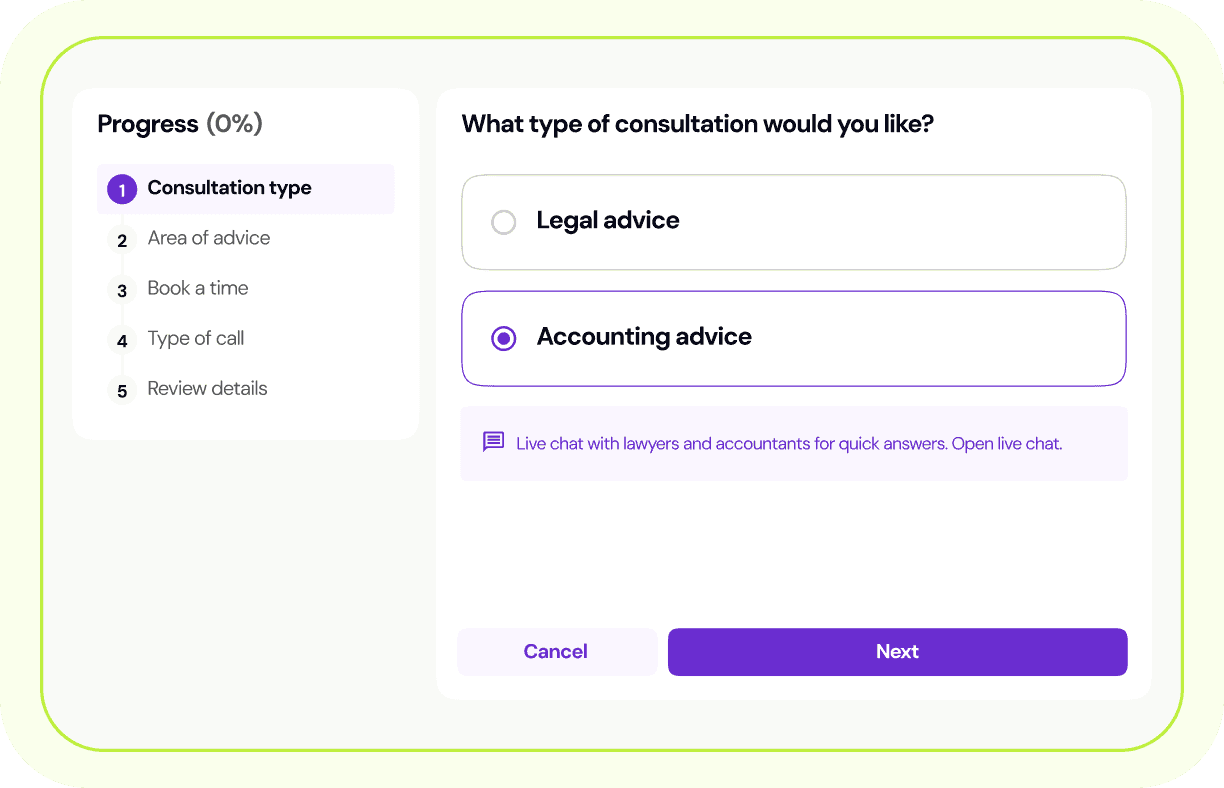

Starting a business means making big decisions early. Your Starter Plan includes a 30-minute consultation with a qualified lawyer or accountant - giving you real, professional guidance on the questions that matter most, right from the start.

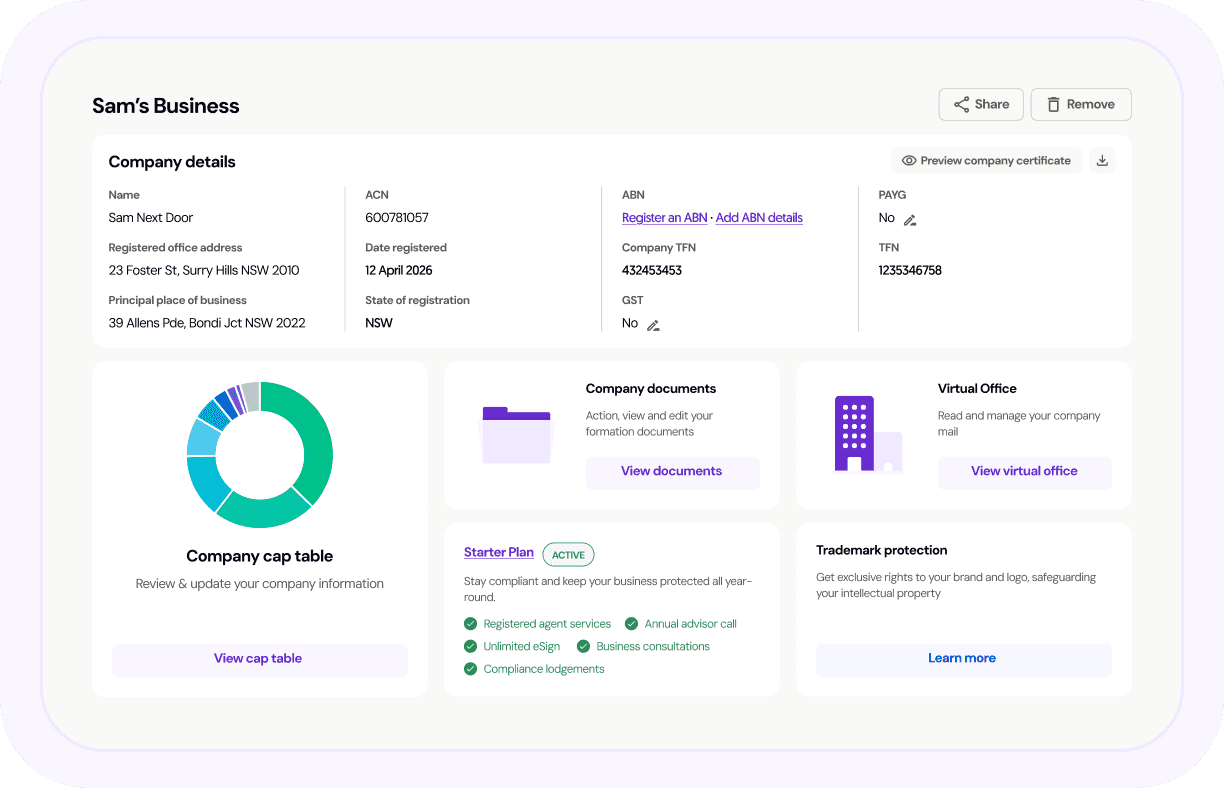

From ATO obligations and Nil BAS lodgements to your annual ASIC review, we've got it covered. Your Starter Plan includes compliance reminders and hands-on assistance to keep your business meeting its obligations.

Verified reviews by

Verified reviews by

Verified reviews by

If you’re just starting out or want foundational support without the complexity, the Starter Plan is built for you. It covers what matters most: compliance support, professional advice, and access to Lawpath’s key tools – so your business has the right foundations in place from day one.

Your plan includes one 30-minute consultation per year with a qualified lawyer or accountant. Use it when you need professional advice most. If you need more, additional consultations are available through our Legal Advice Plan, Accounting Advice Plan or fixed-price quote services.

A wide range of business legal matters, including starting a business, incorporation, restructuring, corporate compliance, employment issues, contractors, trademarks, copyright, trusts, website terms, privacy, debt collection, commercial leases (NSW), breach of contract, licensing, shareholders agreements, service agreements, and more.

Most business accounting needs, including GST advice, business structuring, director payments, bookkeeping, payroll and superannuation, accounting software, tax planning and minimisation, trust setup, business finance, and more.

Yes. The consultation excludes personal, family, criminal, litigation and pre-litigation matters, franchise, not-for-profit, strata, residential property, international law, patent, immigration, and third-party advice for other businesses. Document drafting and clause dictation are also not included. These services are available through our fixed quote options.

The plan covers most business accounting areas but excludes self-managed super funds (SMSF), financial and investment advice, government grants, and international tax. Lodgements and income tax returns are not included in the consultation but are available as additional services through our tax compliance plans and fixed quote options.

Your business consultant will walk you through a compliance review after registration, check that your setup and documentation are complete, introduce you to Lawpath’s tools, and answer your questions about staying compliant. Think of it as an expert onboarding session tailored to your business.

If your business is registered for GST or PAYG but hasn’t made any sales or purchases in a reporting period, you’re still required to notify the ATO by submitting a Nil BAS. Lawpath handles this for you, sending reminders about your obligations and lodging statements on your behalf as your registered ATO agent. As your agent, your lodgements also fall under our extended reporting schedule, giving you more time and helping you avoid late fees.

An ASIC and ATO agents are authorised representatives that receive official communications from the Australian Securities and Investments Commission (ASIC) and the Australian Taxation Office (ATO) on your behalf. As your registered agent, Lawpath makes sure you never miss an important notice, deadline, or obligation related to your business.

Our experts are here when you need them. Clear advice, no pressure.

Our support and sales teams are available to take your call at any time between 9:00am to 6:00pm from Mondays to Fridays.