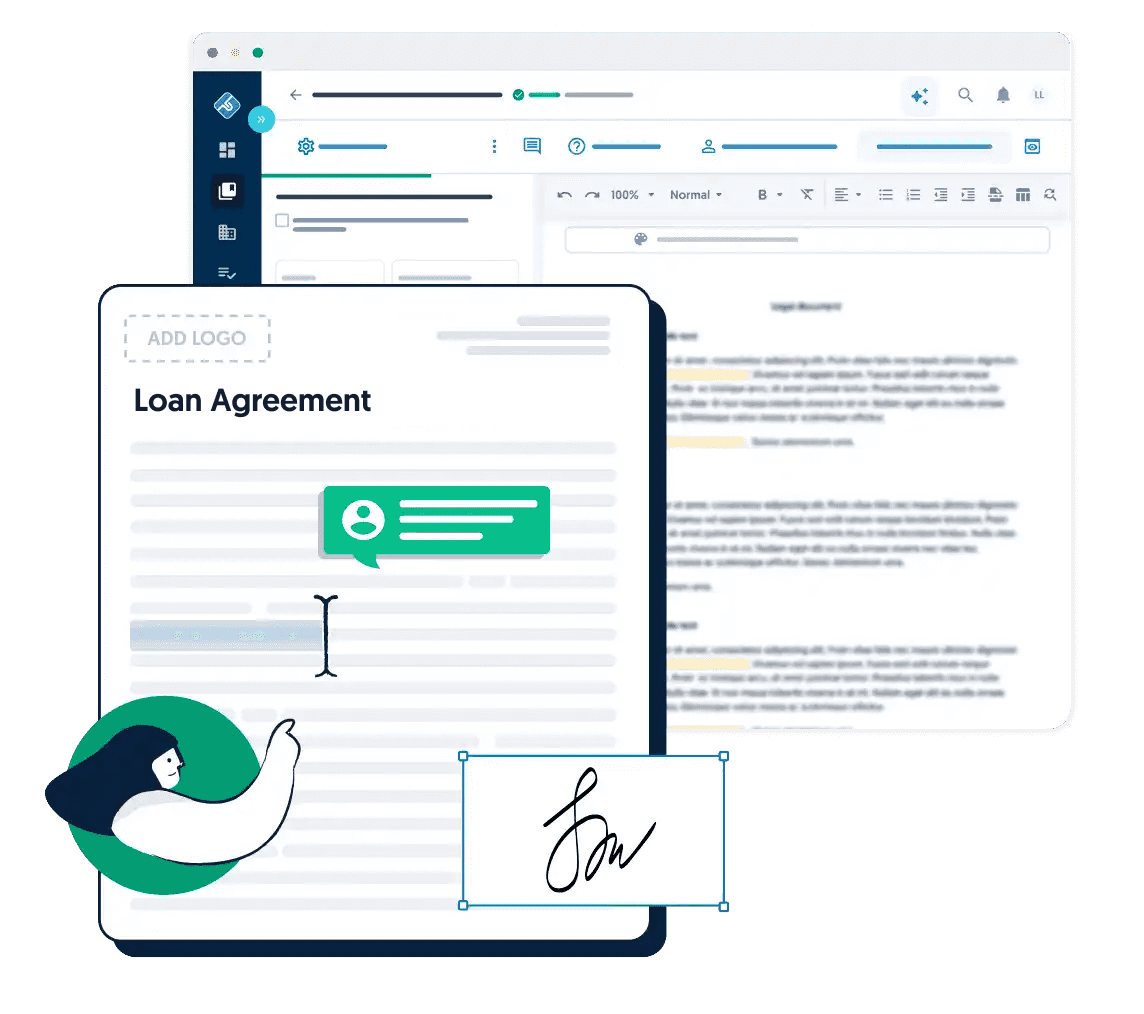

This Loan Agreement can be used by lender when offering a loan to a Borrower.

Laws and regulations are continually evolving, and failure to comply can result in severe consequences for businesses. Our loan agreement is constantly updated by legal professionals to ensure it stays up-to-date with the latest laws and regulations in Australia.

Leveraging advanced Al technology and guided questionnaires, we ensure the loan agreement is customised to meet the unique needs and specific requirements of your business.

With a few clicks and by answering a guided questionnaire, we incorporate your responses into a professionally drafted loan agreement in under 5 minutes.

Create your free account

Find the document you need from our library

Answer a few simple questions to tailor your document

Review, download and share your finished document

A Loan Agreement serves as a legal document that outlines the terms and conditions of a loan, ensuring both parties understand their obligations. Lawpath assists in creating comprehensive Loan Agreements to protect lenders and borrowers.

It’s advisable to use a Loan Agreement when lending a significant amount of money, especially to someone unfamiliar. Lawpath helps by providing clarity on loan terms, repayment structures, and interest rates.

A Loan Agreement typically covers aspects such as repayments, interest, fees, indemnities, and more. Lawpath offers meticulously crafted Loan Agreement templates to ensure all essential elements are addressed in your loan arrangement.

Lawpath recommends consulting a tax accountant for personalized advice on tax implications. We emphasize the importance of understanding tax consequences and provide guidance on related legal matters.

A Loan Agreement establishes terms for the borrower to repay a lender. A Promissory Note is a simpler, shorter document outlining an obligation to pay a set amount. Lawpath clarifies these distinctions and offers both templates.

Yes, Lawpath provides templates for various loan agreements, including Division 7A and Drawdown Loan Agreements, tailored to meet your specific needs.

Yes, interest on personal loans is common. Interest compensates lenders for risk and inflation. Lawpath ensures interest terms are clearly defined in Loan Agreements.

Lawpath offers guidance for individuals with bad credit seeking loans. We recommend steps to improve credit scores and suggest creditors who don’t rely on credit scoring.

Most Loan Agreements feature monthly payments, but Lawpath templates are customizable. You can adjust payment schedules based on your agreement with the other party.

A guarantor clause designates someone responsible for loan repayment if the borrower defaults. Lawpath ensures this clause adds an extra layer of security to your loan agreement.

Sign up to a free Lawpath account and get started.

Our experienced lawyers are here to help.