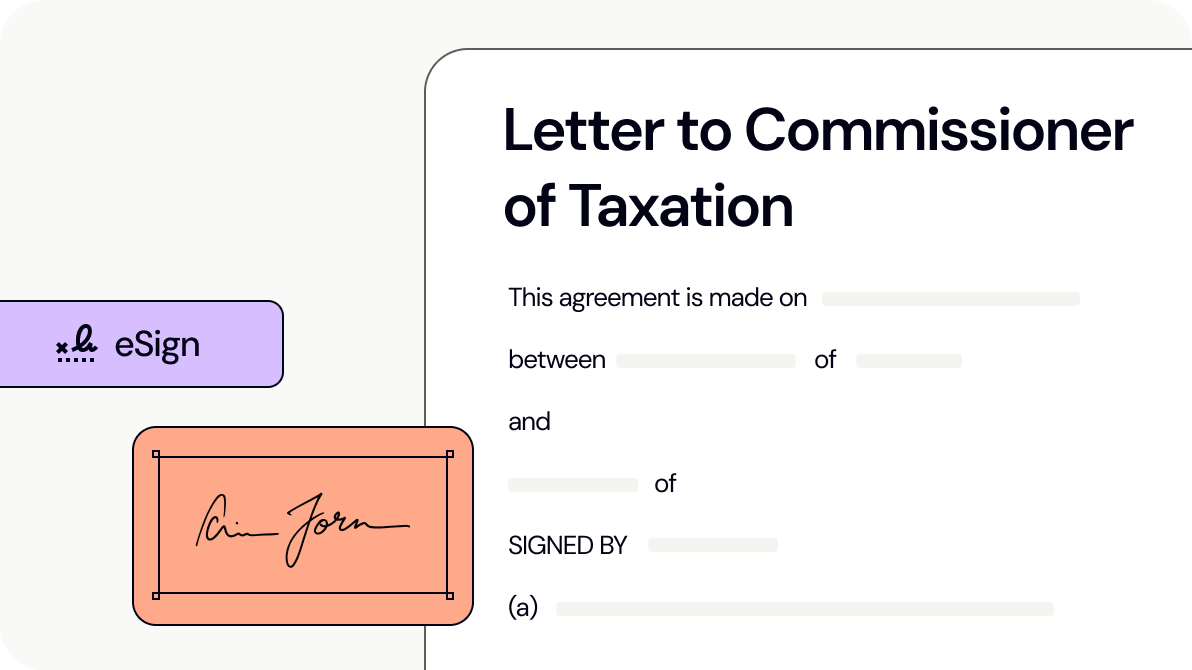

Letter to Commissioner of Taxation

A Public Officer's Letter to Commissioner of Taxation upon incorporation is required by law. It informs the ATO of your company for taxation purposes.

Last updated October 24, 2025

Suitable for Australia

Create & Customise Legal Templates Online

What is a letter to commissioner of taxation?

What is a letter to commissioner of taxation?

When should you use a letter to commissioner of taxation?

When should you use a letter to commissioner of taxation?

What should be in a letter to commissioner of taxation?

What should be in a letter to commissioner of taxation?

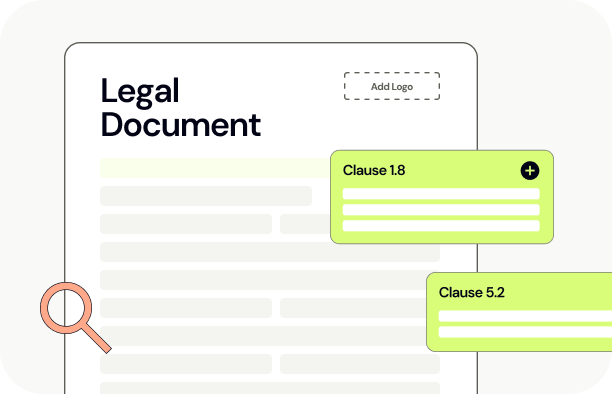

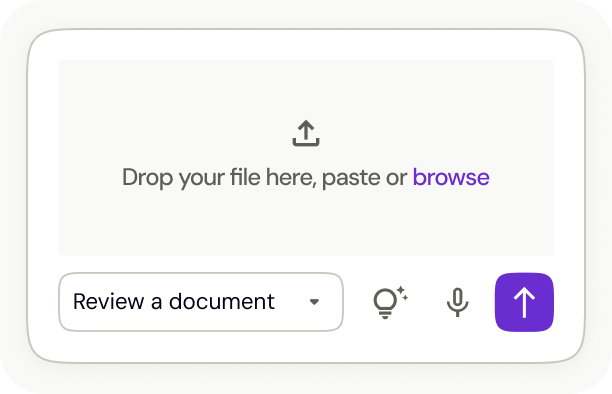

How to create a legal document

- check_circle

Access the Document Library

- check_circle

Select the template that matches your needs

- check_circle

Customise by adding or removing clauses with assistance from Lawpath AI

- check_circle

Personalise with your headers, footers, logos, or additional text

- check_circle

Store all documents securely in your account for easy access

Frequently asked questions

What is a letter to commissioner of taxation?

keyboard_arrow_upWhen should you use a letter to commissioner of taxation?

keyboard_arrow_upWhat should be in a letter to commissioner of taxation?

keyboard_arrow_upWho is required to send this letter?

keyboard_arrow_upWhat are the risks of not submitting this letter?

keyboard_arrow_upCan this document be used in all Australian states and territories?

keyboard_arrow_upIs this document suitable for all company types?

keyboard_arrow_upWhat information do I need to complete the letter?

keyboard_arrow_upHow do I submit the completed letter to the ATO?

keyboard_arrow_upWhat happens after I send the letter?

keyboard_arrow_upView Sample Letter to Commissioner of Taxation

Articles about Letter to Commissioner of Taxation

Looking for more documents?

Non-Disclosure Agreement (Mutual)

A Non-Disclosure Agreement (Mutual) allows you and another party to share confidential information while legally forbidding either party from disclosing that information to any other person or entity.

Non-Disclosure Agreement (One Way)

A Non-Disclosure Agreement (One Way) allows you and another party to share confidential information while legally forbidding the other party from disclosing that information to any other person or entity.

Shareholders Agreement

A Shareholders Agreement allows you to clarify the relationship between shareholders of your company.

Memorandum of Understanding (MOU)

A Memorandum of Understanding is a non-legally binding precursor document that allows you to record proposed terms with another party during the negotiation stage.

Confidentiality Agreement (Mutual)

This Confidentiality Agreement (Mutual) allows you and another party to share confidential information while legally forbidding the other party from disclosing that information to any other person or entity.

Partnership Agreement (General)

A Partnership Agreement (General) governs the relationship between all the partners involved in your business.

Commercial Lease Agreement (Non-Retail) (NSW)

A Commercial Lease Agreement (Non-Retail) is a legal document that can be used when a commercial property is being leased out in NSW.

Constitution (Proprietary Company)

A Constitution (Proprietary Company) is an essential and crucial document that regulates your company's activities and the relationship between your company's directors and shareholders.