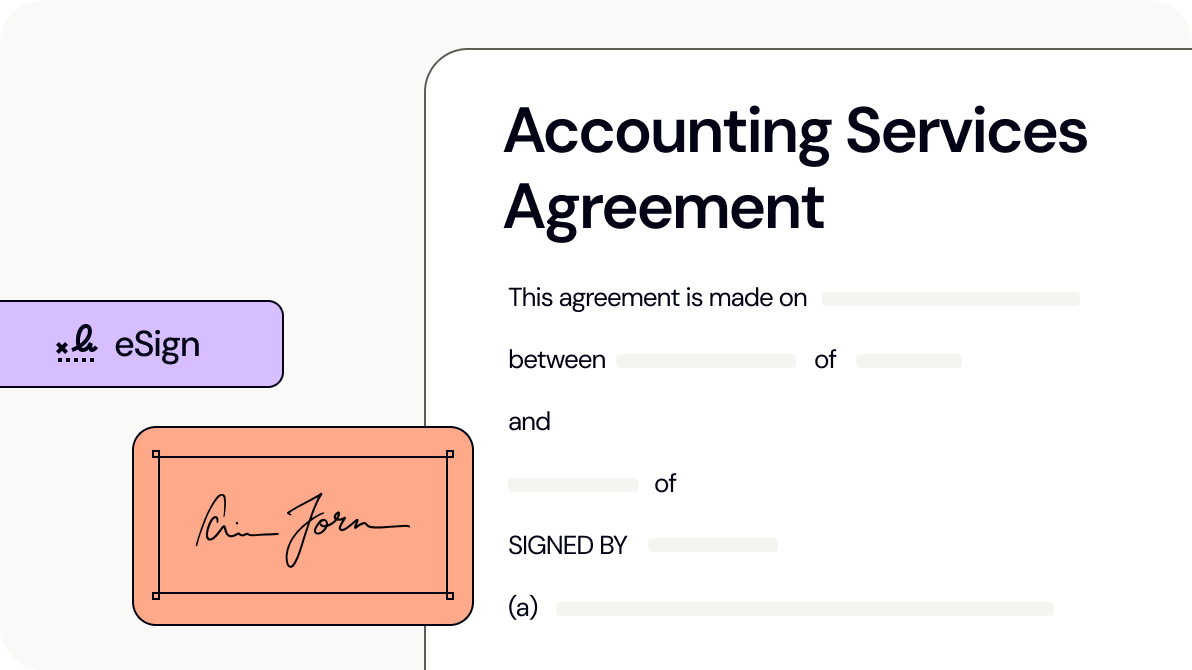

Accounting Services Agreement

Create your Accounting Service Agreement document to set out the relationship between you, the service provider with instant document builder of Lawpath. Try it now!

Last updated November 18, 2025

Suitable for Australia

Create & Customise Legal Templates Online

What is a accounting services agreement?

What is a accounting services agreement?

When should you use a accounting services agreement?

When should you use a accounting services agreement?

What should be in a accounting services agreement?

What should be in a accounting services agreement?

How to create a legal document

- check_circle

Access the Document Library

- check_circle

Select the template that matches your needs

- check_circle

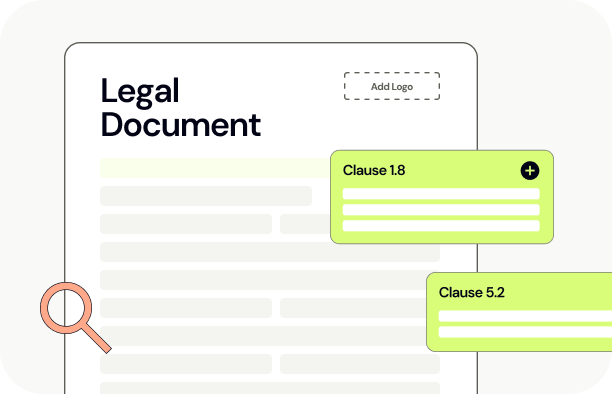

Customise by adding or removing clauses with assistance from Lawpath AI

- check_circle

Personalise with your headers, footers, logos, or additional text

- check_circle

Store all documents securely in your account for easy access

Frequently asked questions

Who is this agreement suitable for?

keyboard_arrow_upWhat protections does this agreement offer?

keyboard_arrow_upAre there any limitations or risks in using this document?

keyboard_arrow_upCan the agreement be customised for different accounting services?

keyboard_arrow_upHow quickly can I complete this document?

keyboard_arrow_upIs this agreement valid across Australia?

keyboard_arrow_upWhat should I check before finalising the agreement?

keyboard_arrow_upView Sample Accounting Services Agreement

The Legal Risk Score of a Accounting Services Agreement Template is Low

Our legal team have marked this document as low risk considering:

- The agreement allows for the modification of service descriptions, but such changes require written consent, potentially slowing down responsiveness to dynamic business needs.

- The confidentiality clauses are strict, with significant liability for unauthorised disclosure or use of confidential information, which could pose a risk if not managed carefully.

- The document places the responsibility for obtaining and ensuring the confidentiality of third-party services on the Provider, which could increase the Provider's risk exposure if third parties fail to comply.

Overall, this document appears to have a balanced approach to risk between the parties involved, with clear outlines on responsibilities, liabilities, and procedural steps for various scenarios. However, the strict clauses related to service modifications and confidentiality, as well as third-party engagements, could introduce complexities and potential risks that users should be aware of and manage carefully. Users with a basic understanding of contractual agreements will find this document comprehensive, yet they should consider whether the specific terms align with their operational flexibility and risk management capabilities.

Meet Our Users

Articles about Accounting Services Agreement

Looking for more documents?

Privacy Policy

A Privacy Policy outlines how your business will use, store and collect your customers' information. A Privacy Policy is required by law in certain circumstances.

Loan Agreement

This Loan Agreement can be used by lender when offering a loan to a Borrower.

Non-Disclosure Agreement (Mutual)

A Non-Disclosure Agreement (Mutual) allows you and another party to share confidential information while legally forbidding either party from disclosing that information to any other person or entity.

Non-Disclosure Agreement (One Way)

A Non-Disclosure Agreement (One Way) allows you and another party to share confidential information while legally forbidding the other party from disclosing that information to any other person or entity.

Business Sale Agreement

A Business Sale Agreement is used to clearly set out all relevant terms of the sale when selling or buying a business.

Shareholders Agreement

A Shareholders Agreement allows you to clarify the relationship between shareholders of your company.

Services Agreement (Pro-Supplier)

This Services Agreement (Pro-Supplier) sets out the relationship between you, the service provider, and the business receiving the services. This version of the Services Agreement is drafted in favour of the supplier from a commercial and legal perspective.

Discretionary Trust Deed

A Discretionary Trust Deed is used to establish a discretionary trust in any state or territory in Australia.