Fast, online Australian Business Number application and Business Name registration

Verified reviews by

Verified reviews by

Verified reviews by

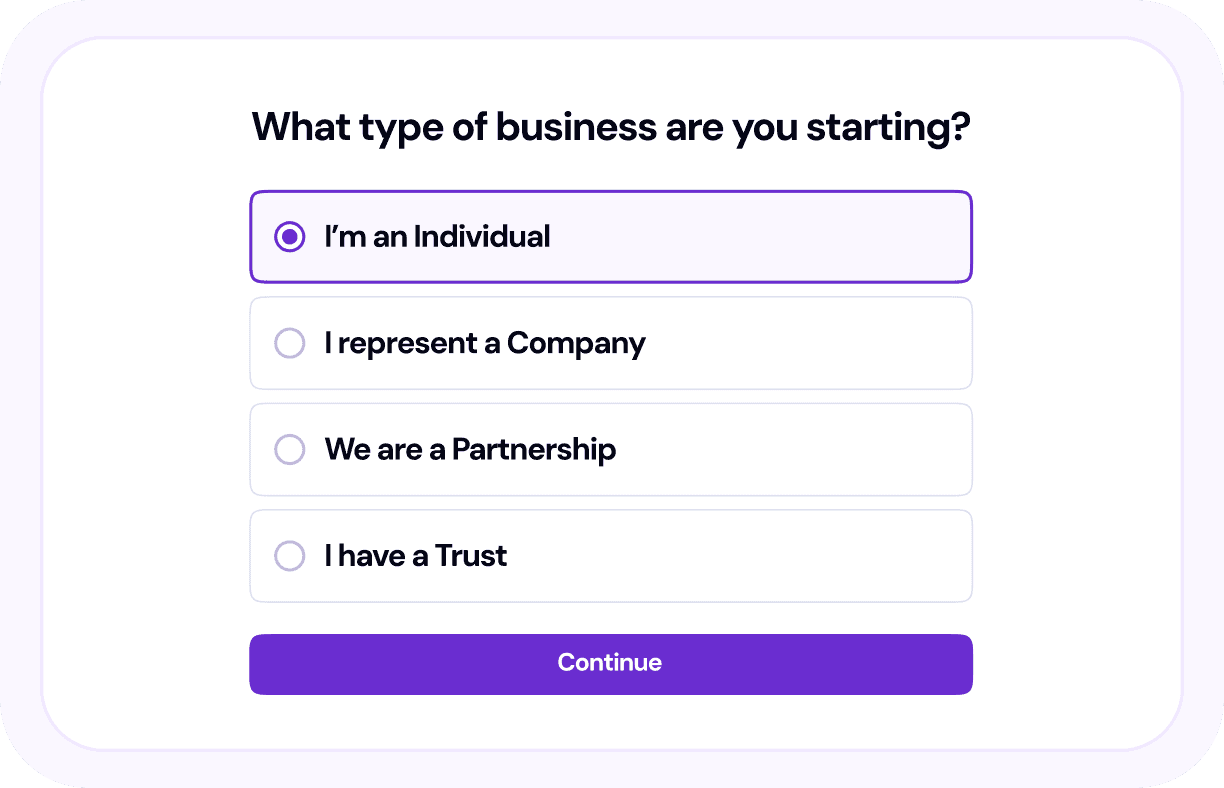

Apply for or reactivate an ABN as a sole trader, with clear steps along the way.

Apply for an ABN once your company is registered.

Register or reactivate an ABN for a partnership, with guidance to help avoid delays.

Apply for or reactivate an ABN for a trust, with support if things get complex.

Complete your application online in just a few minutes. Our guided form keeps things clear, and our team is here if you need support.

When you apply for an ABN with Lawpath, your application is handled by a verified provider, so it is processed properly and securely.

Registering your ABN is just the first step. We also support you with tax plans for sole traders, ongoing accounting advice, legal documents and exclusive partner offers to help you grow with confidence.

Start your application

Start your application online and follow the guided steps.

Submit your application

Review and submit your application in under 5 minutes.

Receive your ABN

Your ABN and confirmation details will be issued within 24 hours.

An Australian Business Number (ABN) is a unique 11 digit number which the ATO will allocate to you. This number is used on your business documents and invoices

You need an ABN to receive all B2B payments, to register for PAYG and GST and to register a .com.au domain and business name(s). Having an ABN will also enhance the legitimacy of your business.

You are entitled to an ABN if you are carrying on an enterprise in Australia, a company or making supplies connected with Australia’s indirect tax zone.

You will need to provide the following information when applying for your ABN:

Your ABN may be delayed if:

If your application has been rejected, you have the option to dispute it within 60 days. You should detail why you are objecting to the decision and provide supporting documentation. Please note that we do not provide refunds for rejected applications.

Our experts are here when you need them. Clear advice, no pressure.

Our support and sales teams are available to take your call at any time between 9:00am to 6:00pm from Mondays to Fridays.