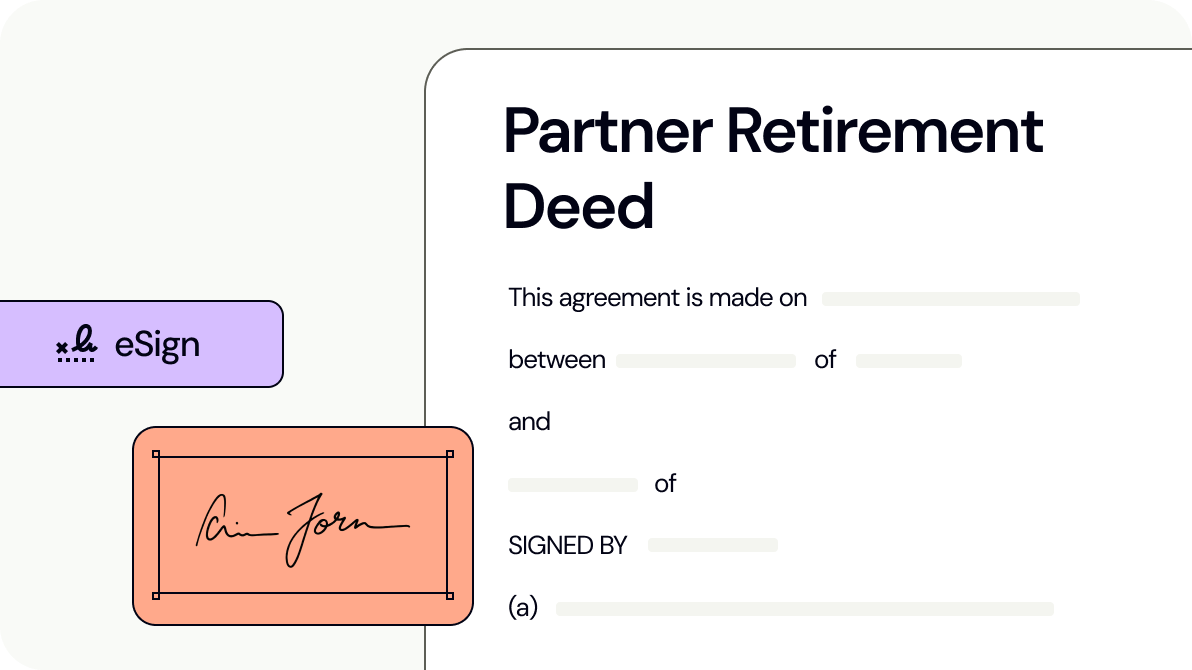

Partner Retirement Deed

This Partner Retirement Deed sets out the terms under which a partner agrees to retire from a business partnership, leading the partnership to dissolve with a new one taking its place.

Last updated January 22, 2025

Suitable for Australia

Create & Customise Legal Templates Online

What is a partner retirement deed?

What is a partner retirement deed?

When should you use a partner retirement deed?

When should you use a partner retirement deed?

What should be in a partner retirement deed?

What should be in a partner retirement deed?

How to create a legal document

- check_circle

Access the Document Library

- check_circle

Select the template that matches your needs

- check_circle

Customise by adding or removing clauses with assistance from Lawpath AI

- check_circle

Personalise with your headers, footers, logos, or additional text

- check_circle

Store all documents securely in your account for easy access

Frequently asked questions

What protections does this deed provide for both parties?

keyboard_arrow_upAre there any risks or limitations with this deed?

keyboard_arrow_upDoes this deed automatically dissolve the existing partnership?

keyboard_arrow_upCan the retiring partner’s name continue to be used in the business?

keyboard_arrow_upWhat happens to incomplete contracts and business assets?

keyboard_arrow_upHow quickly can this deed be completed?

keyboard_arrow_upIs this deed valid across Australia?

keyboard_arrow_upView Sample Partner Retirement Deed

The Legal Risk Score of a Partner Retirement Deed Template is Medium

Our legal team have marked this document as medium risk considering:

- The document allows the Continuing Partners to use the Retiring Partner's surname in the business name for a specified period, which could affect the personal brand and reputation of the Retiring Partner if the business practices change post-retirement.

- This document must be signed as a deed to be effective.

- The requirement for the Retiring Partner to sign and execute all documents that the Continuing Partners deem necessary might lead to unforeseen obligations or constraints on the Retiring Partner's future business activities or personal freedom.

The extent of control and obligations imposed on the Retiring Partner, particularly in terms of future actions and use of their name, could present risks that need careful consideration and might necessitate further legal advice to ensure that their rights and future prospects are adequately protected.